This article originally appeared in the Financial Standard on 18 November 2024

India's stock market has been on an upward run, outpacing most major emerging and developed markets over the past five years. This surge has been fuelled by various factors, including robust earnings growth and consistent inflows from domestic investors, fostering a bullish sentiment and taking valuations to extreme levels.

Over the last four decades, India has solidified its position as one of the fastest-growing economies worldwide. This growth has been largely driven by consumption, thanks to India’s huge youth population, its expanding middle class and rising incomes.

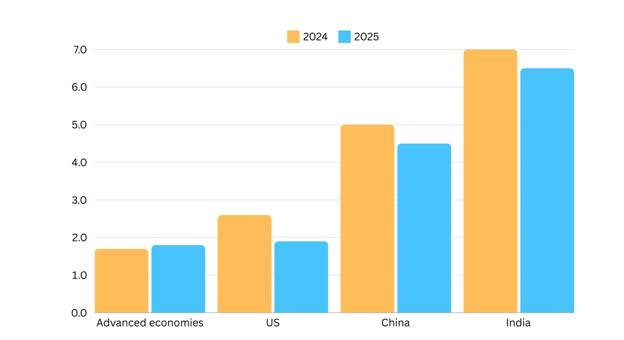

The International Monetary Fund (IMF) has recently upgraded India's gross domestic product (GDP) in the FY2024-25 by 20 basis points to 7% given a notable rise in consumption prospects, especially in rural areas where demand has been weak in the last couple of years. With this, India has maintained its position as the fastest-growing economy among advanced and emerging and developing economies, as the chart below shows.

GDP Growth (Percent Change, year-on-year)

Source: Press Information Bureau, Government of India

In addition to consumption, growth has come from the government’s infrastructure push - it has doubled infrastructure spending in FY2020-25 versus the preceding five-year period. Going forward, its production-linked tax incentives for manufacturing are likely to boost economic activity over the next 5-10 years if implementation is proper.

All this has driven valuations to high levels compared to other Asian and emerging market (EM)s, and even when comparing to its own history. There is a lot of froth in the market, particularly in the small cap space, futures and options trading as well as in the primary market. Retail participation has considerably increased and it is currently important to maintain a more cautious approach when investing in the Indian market.

However, one can still find investment opportunities at reasonable valuations if they apply a bottom-up stock picking approach and have a long-term investment horizon in this market.

Demand for banking products and services

One segment of the Indian market that deserves attention is private sector banks and financial companies. India boasts a selection of private sector banks that are arguably among the best in EMs in terms of long-term return and growth prospects. The country's low mortgage and credit card penetration rates, compared to China and the US, highlight the immense potential for growth in this sector. Indian banks are reaping the benefits of both the growing penetration of banking services within the country and market share gains from their government-owned counterparts.

As the Indian economy expands and more people enter the financial system, the demand for banking products and services is expected to rise. This presents a significant opportunity for private sector banks as well as non-banking microfinance companies to expand their customer base and loan books. Moreover, the government's push for financial inclusion and digital payments is further driving the growth of the banking sector.

Riding the wave of consumers’ rising aspirations

The consumer discretionary sector is another fertile ground for investment opportunities. From consumer goods to dining out and travel, India is witnessing a significant shift in consumption patterns.

The low ownership rates of automobiles and air conditioners in India, for example, underscore the vast untapped potential in this sector as the middle class grows and people buy more goods and services to enjoy life and make themselves more comfortable. Several companies are benefiting from growing penetration of consumer goods and services, even compared to other EMs in the region, as the rising disposable incomes of Indian consumers drive the demand for a wide range of discretionary products and services.

Manufacturing to drive growth

While India's service sector has long been a pillar of the economy, contributing about 50% of the country's GDP, its manufacturing sector has lagged. However, the government's focus on improving infrastructure and implementing production-linked incentives has raised hopes that manufacturing could emerge as India's second engine of growth, following consumption. New investment intentions in sectors like electronics, chemicals, and textiles are encouraging signs of this potential transformation.

The growth of the manufacturing sector has the potential to create millions of new jobs, reduce India's dependence on imports and help to attract foreign investment to the country.

Embracing digital innovation

The growth of internet and new-economy business models are very important to the country. India has one of the largest and fastest-growing internet user bases in the world. This, coupled with the increasing affordability of smartphones and data plans, and a free and instant digital payment ecosystem has led to a surge in digital adoption across the country. The COVID-19 pandemic further accelerated this trend, as people turned to online platforms for their daily needs. As a result, new internet businesses in areas such as e-commerce, insurance, food and grocery delivery, and ride-hailing are gaining traction and are now getting listed.

While risks exist, the country’s economic dynamism, coupled with the broader appeal of higher growth and better demographics, presents a compelling investment proposition if one has a long-term investment horizon to help tide over short periods of volatility. Any correction in the market could provide an entry point at a more reasonable valuation. The broadening of the Indian equity market with a host of new listing in the last 2-3 years is now providing a wider set of investment options to investors.

The broader EM landscape deserves attention

Beyond India's specific strengths, investing in EMs more broadly offers compelling benefits. While the asset class is a collection of countries that are very different economically, politically, and socially, they have as a group consistently outpaced developed countries in terms of GDP growth. They now contribute over 50% of global growth, with expectations to contribute over 60% by 2025 .

Many EMs have transitioned from a peripheral position in the world economy once dominated by agriculture and cheap manufacturing to become home to some of the world's fastest-growing and most innovative companies, including in China, India, Indonesia, Brazil, Mexico, Korea and Taiwan.

EMs, hence, offer investors the opportunity to tap into the growth potential of these dynamic economies. They may provide diversification benefits to investment portfolios, as their performance is often less correlated with that of developed markets. Moreover, collectively EMs are home to a vast array of companies across various sectors, potentially offering a wide range of investment opportunities for those seeking growth and diversification.