Updated March 2025

There’s so much more to global investing than the mega household names such as Apple and Amazon. We can explore the entire universe of diverse opportunities with our research resources.

James Abela, Co-Portfolio Manager, Fidelity Global Future Leaders Fund

Looking beyond the large caps

Although large-caps dominate the headlines, it would be a mistake for investors to ignore the multitude of mid-caps and small-caps on offer. Particularly in today’s market, there is a strong argument that this asset class can offer important growth potential and diversification benefits to your global portfolio.

The difficulty lies in identifying these future industry leaders at their early stages of growth – keeping in mind that for every Apple that makes it, countless others don’t.

Investment analysts tend to focus most of their research efforts on large-caps, which comprise the bulk of major indices and investment portfolios.

Yet therein lies the opportunity. The relative lack of research on mid-caps and small-caps increases the likelihood that high-quality businesses with tremendous growth potential are ‘flying under the radar’ and trading at attractive valuations.

Table 1. Characteristics of market segments

A useful way to view the equity market is to segment companies in terms of their market capitalisation, or market cap. In this way, each listed company can be broadly categorised as large-cap, mid-cap or small-cap, depending on its value.

Each category brings its own set of opportunities and risk/return profile. Small- and mid-cap segments of the market often have different characteristics relative to large-cap segments, as this table illustrates.

| Large-cap | Mid-cap | Small-cap | |

|---|---|---|---|

| Maturity level | Generally well established | Generally established | Can be earlier stage |

| Volatility | Low | Medium | High |

| Potential for high returns | Low | High | High |

| Potential for negative returns | Low | Medium | High |

| Liquidity (ease and cost of trading) | Very good | Good | Typically low |

| Availability of company information and detailed research insight | Very high | High | Typically low |

The opportunity for strong long-term growth

Investors are most familiar with large-cap stocks, which dominate well-known market indices. We’ve seen the impact of market concentration in recent years with a handful of US mega-cap technology stocks driving most of the overall performance of the MSCI World Index.

The ‘FAANGs’ (Facebook/Meta, Apple, Amazon, Netflix, Alpha/Google) started gaining prominence in 2018, and more recently evolved to the ‘Magnificent Seven’ (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla). They have delivered investors strong performance, but with large-cap valuations currently at all-time highs, is it the right time for investors to look beyond these companies for long-term growth and diversification?

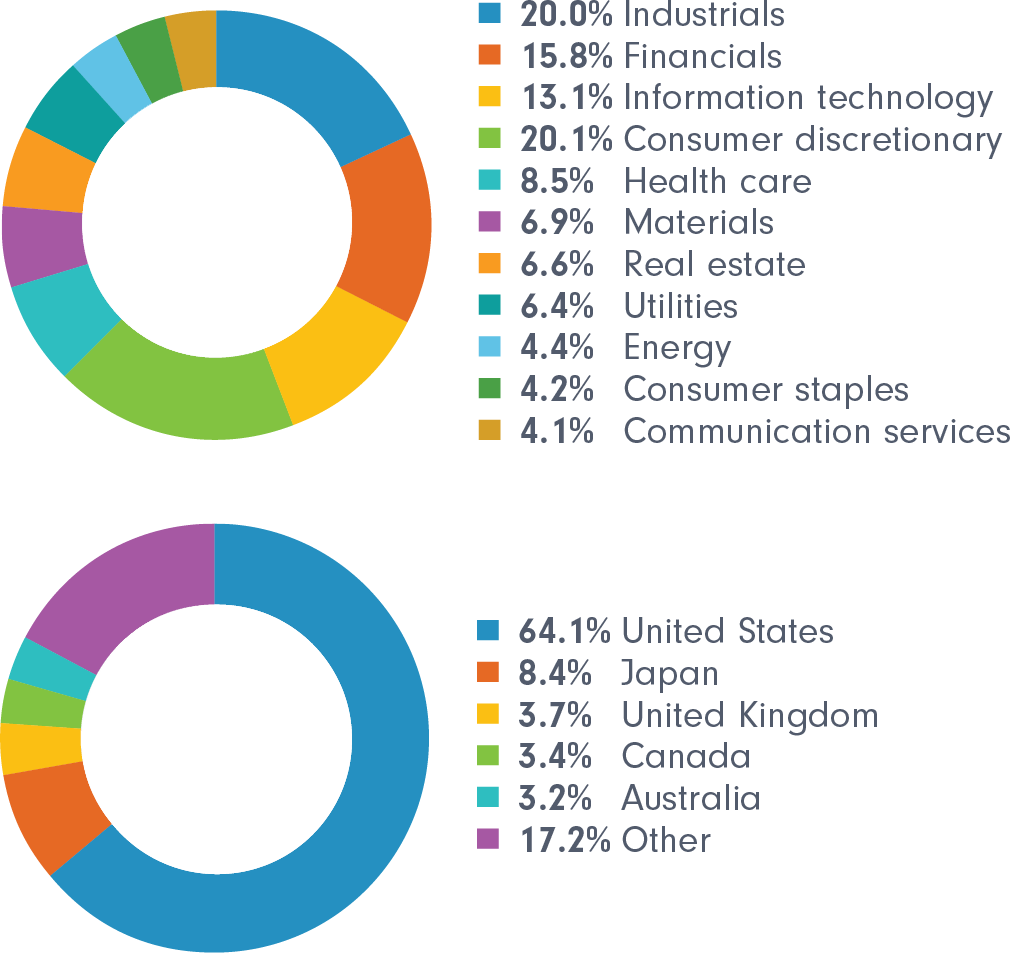

Over the past 25 years, global mid-caps and small-caps, as a market segment, have generated higher returns than large-caps (Figure 1).

Figure 1. Long-term total returns profile comparison (US$)

Source: Refinitiv DataStream, Data period from 1 January 2001 to 31 January 2025.

Looking ahead, new leaders will continue to emerge from the mid-cap segment – in part due to the difficulties incumbents face in staying ahead of the curve. After all, large established firms may not have the appetite to develop new, disruptive technologies or ways of operating.

There are plenty of examples. In some cases the delay in understanding the need to evolve has significantly limited businesses’ prospects. We saw this with Kodak not adapting to the digital revolution and Blockbuster dismissing the potential of streaming, both resulting in bankruptcy. Sears suffered after failing to embrace e-commerce. IBM underestimated the importance of software and the consumer market, focusing too much on hardware and enterprise solutions.

Small- and mid-cap companies may also make inroads into markets held by incumbents much faster than expected. Few imagined Nvidia’s success story from its IPO in 1999 as a graphic card company to an artificial intelligence (AI) company, and now one of the most valuable companies in the world. The company’s GPUs are now driving supercomputers, AI chatbots and driverless cars.

There are other instances where smaller businesses have focused on the development of technological expertise and proprietary solutions to resolve very specific issues and build market leadership. This is prevalent among the small- and mid–cap segment within health care. One example is TransMedics, whose proprietary organ transplant platform extends the viability of donated organs for transplants.

Successful companies in the global mid-cap universe are typically structural winners, technology disruptors, innovators, category killers or brand leaders. Some are unique niche operators or specialists that dominate their field. Others are part of a large global theme.

Table 1. Small- and mid-cap themes

| Sector | Themes |

|---|---|

| Technology |

|

| Energy, resources and utilities |

|

| Consumer |

|

| Financials |

|

| Health care |

|

Many of these businesses are also founder-led. Where they are, their management teams tend to be innovative and agile, and their interests are generally strongly aligned with shareholder interests.

Diversifying your global portfolio

If you’re invested in global shares, it is likely that your portfolio may be heavily weighted in large-cap US tech stocks. Adding global small- and mid-cap companies can help diversify your portfolio.

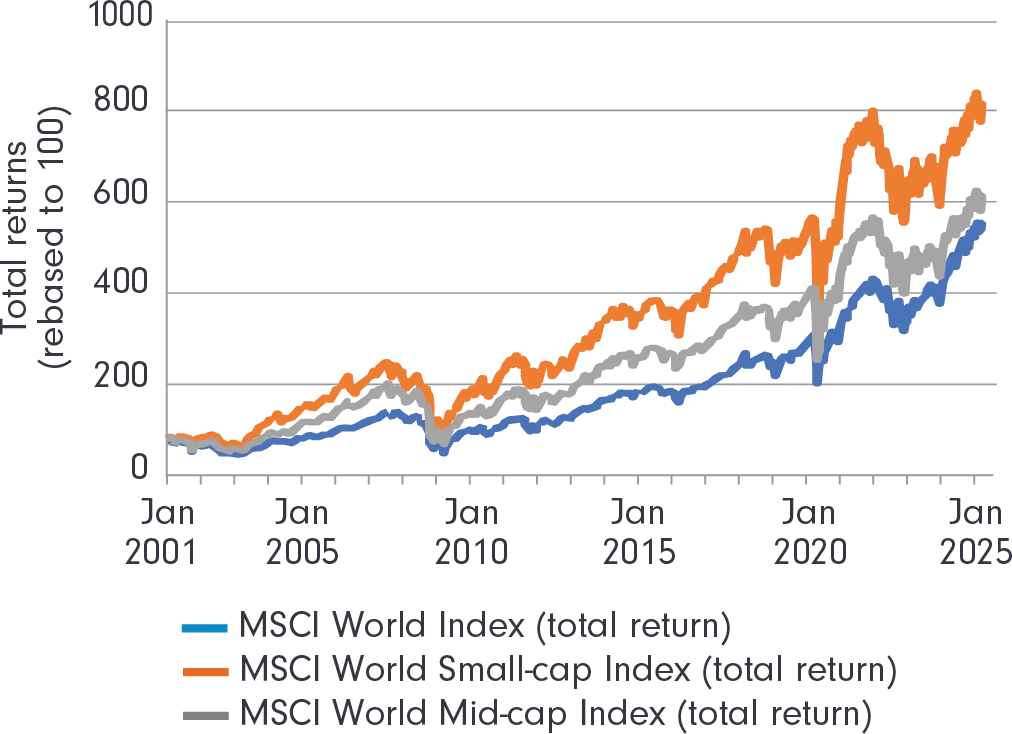

The global mid-cap stock universe is far more diversified than the large-cap MSCI World Index. There are no single stocks, or groups of stocks, dominating this market and no stocks that are more than a small percentage of the overall market, reducing the risk of portfolio concentration (Figure 2). Additionally, with a much lower weighting to technology, a mid-cap exposure can offer an excellent complementary exposure for a portfolio already with investments in large-cap technology companies.

Figure 2. MSCI World Mid Cap Index sector and country weightings

Source: MSCI World Mid Cap Index (USD) as at 31 January 2025.

The benefits of active management

While the opportunity to find the next ‘multi-bagger’ is enticing, the reality is that just a handful of today’s small-caps and mid-caps will one day emerge as a future leader. Defining the ingredients to success requires a deep understanding of the competitive nature of a company’s market, their competitors, the financial position of the company and what is unique in their product or service that differentiates them.

The global mid-cap universe provides investors the opportunity to capture significant growth delivered by fundamentally robust businesses, as shown by the long-term returns generated by some of the stocks identified by our disciplined investment process in Table 3.

Table 3. Returns generated by global mid-cap opportunities

Example of top 10 holdings (as at 31/01/2025) in Fidelity Global Future Leaders Fund

| Company | Sector | Region | Portfolio weight | Total returns over a decade* |

|---|---|---|---|---|

| Brown & Brown | Financials | US | 3.5% | 647% |

| CBRE Group | Real Estate | US | 3.4% | 348% |

| Ares Management | Financials | US | 3.3% | 1510% |

| NVR | Consumer Discretionary | US | 3.3% | 539% |

| Scout24 | Communication Services | Germany | 3.1% | 240%* |

| Moncler | Consumer Discretionary | Italy | 3.0% | 414% |

| AppLovin | IT | US | 2.8% | 467%+ |

| Gartner | IT | US | 2.8% | 545% |

| Auto Trader Group | Communication Services | UK | 2.6% | 272%^ |

| CDW | IT | US | 2.6% | 549% |

* Source: Fidelity International, Refinitiv DataStream as at 31 January 2025. Calculated on a daily basis from 30 January 2015 – 31 January 2025 in local currency terms. Companies not listed for 10 years have total returns calculated from initial listing date provided below:

* From 30 September 2015.

+ From 15 April 2021.

^ From 18 March 2015.

Reference to specific securities should not be taken as recommendations to the investor to buy, sell or hold the same and may not represent actual holdings in the portfolio at the time of viewing. Performance of the security is not a representation of the Fund’s performance.

To uncover the best opportunities for outperformance in this market, portfolio managers need extensive research capabilities to find these diamonds in the rough that live outside the Index. Fidelity’s large global research platform includes a team of analysts dedicated to small-mid cap research across geographies that enables our investment team to identify opportunities that may be missed by others.

A proven manager in mid-small caps

The Fidelity Global Future Leaders Fund and Active ETF are jointly managed by two experienced investment professionals, James Abela and Maroun Younes. Co‑Portfolio manager James Abela has over 25 years’ investment experience and has been successfully managing the Australian-specific Future Leaders Fund since its inception in 2013.

Co-portfolio manager Maroun Younes brings over 15 years’ experience covering a variety of sectors including telecommunications, media, technology and resources. Both focus all their energy and expertise in finding the best opportunities in the

small- to mid-cap universe.

Along with their wealth of experience, these proven portfolio managers leverage insights from one of the world’s largest research teams.

Case Study: AppLovin Corp

Right now, there are a lot of innovative global small- and mid-cap companies quietly reshaping industries. One example is AppLovin Corp, a leading US-based mobile technology and advertising platform that leverages AI to optimise user acquisition, ad placements and revenue generation across its ecosystem. We see this company as one with a proven competitive advantage and pivoting its business to capitalise on its strengths.

Historically, the company owned a collection of mobile video games, but the real gem has been their advertising tech business. It effectively links the buyers of the advertising placements shown in the video games directly to the game studios who supply the ad placement inventory. Similar to how large social media businesses (i.e. Facebook, Instagram) use their own platform to connect to potential advertisers. This incredible revenue growth has led to an expansion of AppLovin’s total addressable market.

Additionally, the company’s industry-leading ad-matching software Axon 2.0 algorithm self-learns each day, reducing the risk of competitors catching up to its technology. The recent success of the app has enabled the company to shift its strategic focus to its ad-tech business and expand beyond gaming advertisements to e-commerce and other non-gaming verticals.

Explore the Fidelity Global Future Leaders Fund

Explore the Fidelity Global Future Leaders Active ETF (ASX:FCAP)