The past two years have been marked by a fear of how bad the first sustained economic slowdown since 2008 might become. Yet our annual survey of Fidelity International analysts suggests the conditions are settling into place for companies to look towards the expansion that should follow.

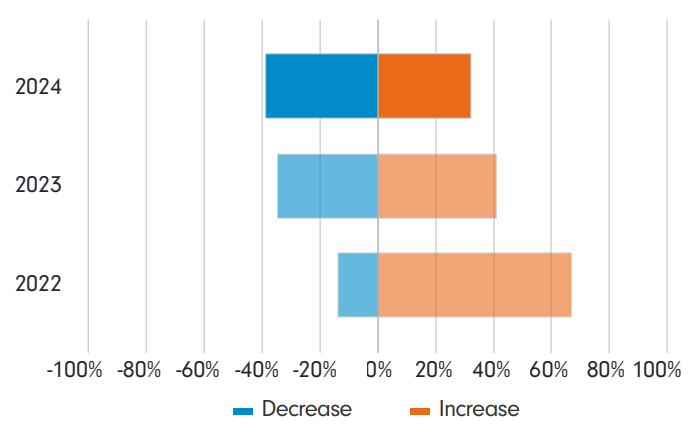

Every sector has its own cycle. The results of our annual survey of Fidelity’s company analysts shows nearly half (48 per cent) say the sectors they cover are now in economic slowdown or, in a handful of cases, outright recession. Yet conditions for turnaround are ripe. For the first time since the pandemic more of our analysts think companies’ cost inflation will fall rather than rise in the year ahead. “No one talks about inflation anymore,” says Brendan Cochrane, who covers North American consumer discretionary companies. “Labour wages were the last sticky aspect, but these seem to be normalising quickly as well.”

Debt loads for most look manageable. Most CEOs expect earnings will grow. Asia appears as a bright spot, especially Japan. China’s recovery from the Covid era, while still fragile, has received a boost from recent stimulus measures.

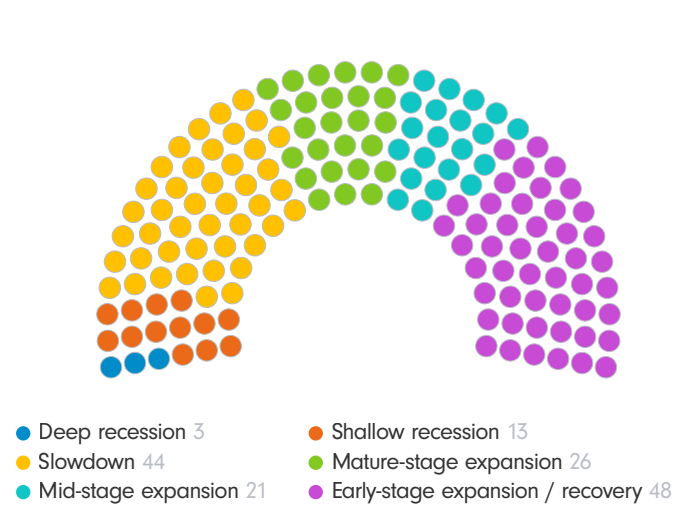

Chart 1: Stage of the cycle in your sector in 12 months?

That is not to say the outlook is for clear blue skies. Many of the indicators in the survey, which gathers 155 responses from equity and credit analysts who cover businesses on the ground, are the most downbeat in years. A year of elections around the globe also comes with major geopolitical risks. But look forward 12 months, as Chart 1 shows, and some 61 per cent of our analysts expect their sectors to be back in expansion mode.

Chart 2: Cost inflation pressures finally abating

Chart shows responses to the question: ‘How, if at all, do you expect inflationary pressures within your companies’ cost bases to change over the next 12 months?’ Analysts who responded ‘No change’ are not shown on the chart. Source: Fidelity International, January 2024.

No maturity wall

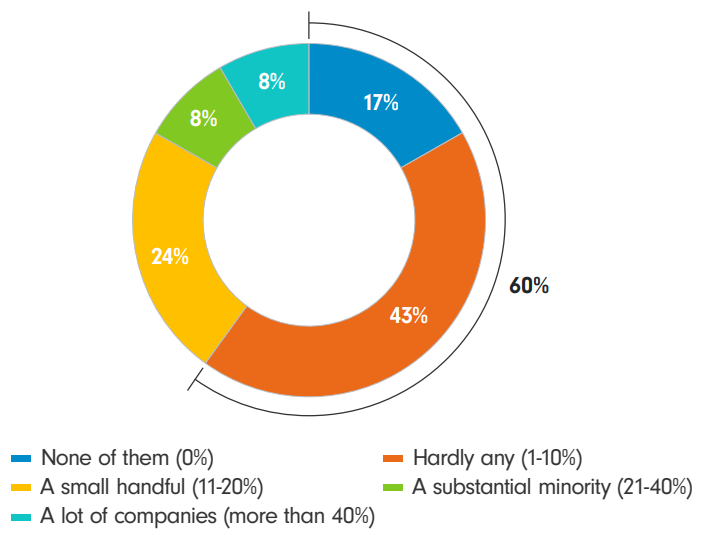

The central macroeconomic argument last year for a slide into a painful and damaging recession was that sharply higher interest rates would hurt consumers and businesses, particularly in Europe and the USA. That didn’t come to pass, and our analysts’ assessment again this year is that most companies can further defer any meaningful debt refinancing: 60 per cent of the analysts believe that less than one company in every 10 they cover will need to roll over substantial sums of debt.

Only 8 per cent of analysts think there will be any trouble accessing finance for those who need to, and these financing challenges are concentrated in sectors and regions where financing pressures are well understood by the market.

Chart 3: 60 per cent of analysts say 1 in 10 companies - or fewer - will have to refinance meaningfully this year

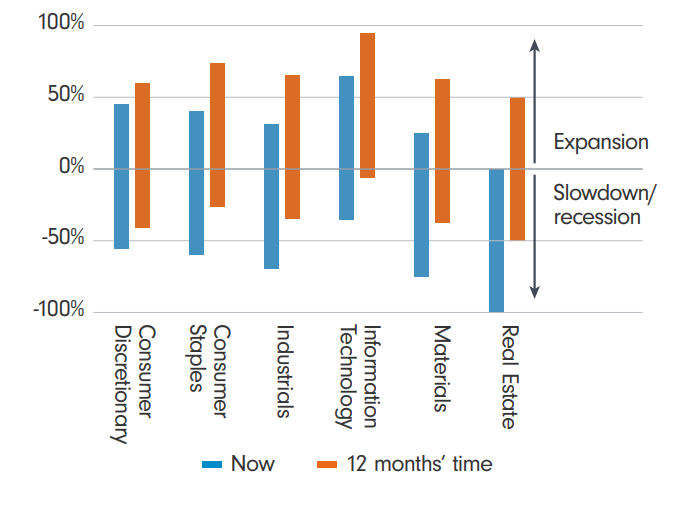

In the meantime, bond markets have already pivoted towards lower rates . One obvious beneficiary, as Chart 4 suggests, could be listed real estate companies. “The [market] rates decrease triggers optimism that we could be nearing the trough of valuation declines,” says Othman El Iraki, a fixed income analyst covering Europe’s battered real estate sector.

Chart 4: Stages of the cycle by sector - expansion vs slowdown

Toughing it out

For most sectors, the analysts who cover them expect that they will show improvement this year, with the proportion who say their sector is in expansion mode rising from 52 per cent right now to 61 per cent who expect that to be the case in 12 months’ time. “Meetings with management teams have been surprisingly positive on the 2024 outlook,” says James Filsell, who covers European industrials.

There are, however, a handful of sectors where our responses suggest conditions may prove tougher as the year goes on.

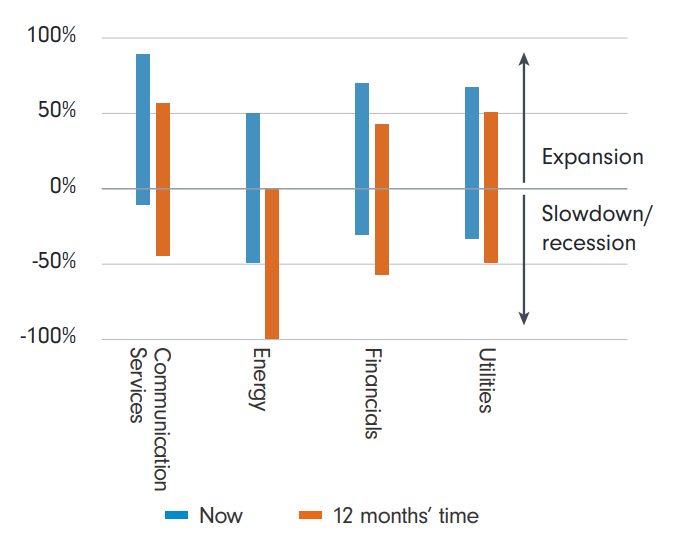

Chart 5: Stages of the cycle - under threat

Our analysts who cover North American and European oil and gas firms cite lower commodity prices as a headwind for the energy sector.

The financial sector will also see the flip side of the retreat in interest rates.

“Two factors are driving the somewhat negative sentiment,” says Sukhy Kaur, a fixed income analyst who covers Nordic and Benelux banks. “Net interest income looks to have peaked across the majority of my coverage in the last quarter and, for some, inflationary pressure, particularly wages, will continue into 2024.”

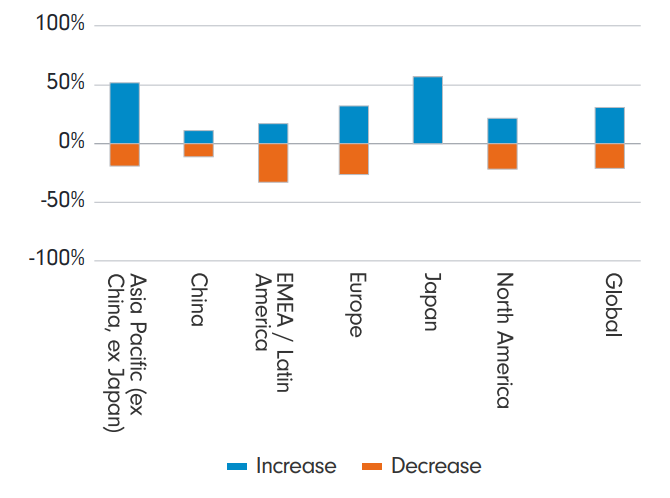

Asian exceptions

A similar split amongst regions is writ large across many of the survey’s results. Fewer than a third of all analysts say returns on capital (ROC) will increase at their companies, but more than half of analysts covering Japan and Asia ex-China are expecting an improvement.

“Companies have a much better handle on costs and margins,” says Rahul Gupta, who covers APAC internet companies, citing lower competition and an increase in consumer spending as additional tailwinds.

In China, however, only 11 per cent say returns will improve.

Chart 6: Are returns on capital set to rise or fall?

Geopolitical backdrop

Our analysts also identify events that could knock their soft-landing narrative off course. The most immediate is the glut of elections this year: more people will be asked to cast a vote in 2024 than in any other previous year in history, creating the risk of disruption.

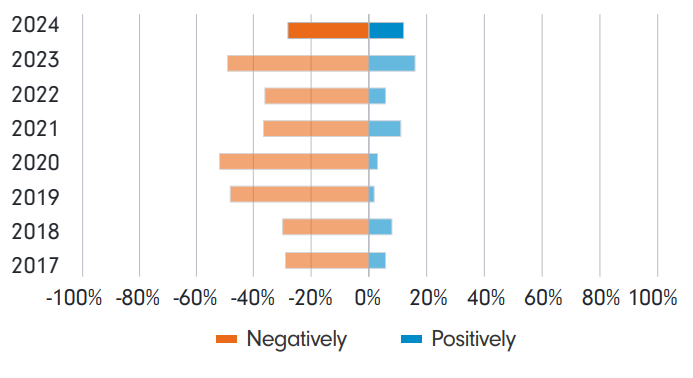

There is division among companies when it comes to talking about election risks. Much boils down to particular scenarios in specific sectors. Only 28 per cent say the current geopolitical backdrop is encroaching on investment plans - the smallest proportion of analysts to say this since we started asking this question in 2017. But European industrials analyst Tristan Purcell cites the US presidential election as the biggest risk factor to the fundamentals of the companies he covers: “Trump winning materially increases the likelihood of reversing stimulus measures like the Inflation Reduction Act and Chips Act that have benefitted [companies in] my coverage.”

Chart 7: How will geopolitics affect strategic investment plans of the companies you cover?

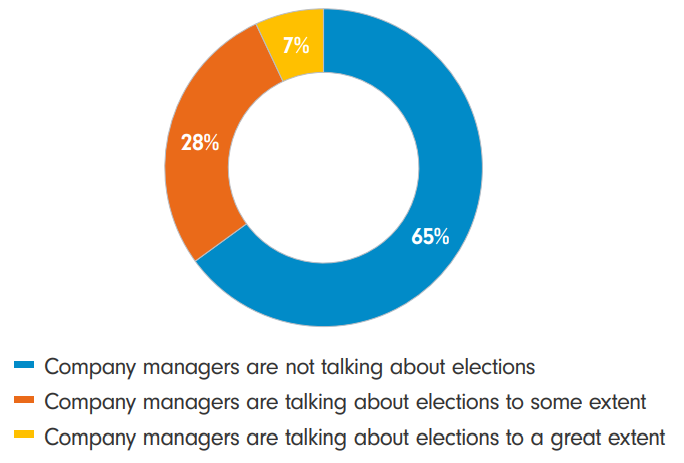

One of the survey’s most striking findings, however, is that most analysts (65 per cent) say their companies are not talking about elections at all.

“I do think that the companies I cover are not talking enough about these risks, it is a blind spot,” says Andras Karman, who covers European and North American auto manufacturers who are intimately tied to China and the fluidity of global trade. “I attribute this in part to the very sensitive nature of doing business in China.”

Chart 8: Not talking about a revolution

Jonathan Tseng, who covers semiconductor producers in North America and Europe, says companies are lobbying heavily behind the scenes but that few see any upside in wading into politics publicly given the unpredictability of the electoral outcomes this year.

“Even if you had a strong view, you'd be crazy to articulate it given history has showed the odds will be shifting right up to, and beyond, polling day,” he says.

Alan Zhou, who covers Asian conglomerates, explains the complexity companies face: “For autos, I think geopolitical risks will increase company costs mainly because they are unable to take care of multiple market interests with one supply chain anymore.”

But he adds that geopolitical tensions have actually been positive for conglomerates with resource assets because they have benefitted from price rises.

Next phase

The end of the era of zero rates was always going to bring tensions. We are already in a period where companies tighten belts, demand comes under more pressure, and pricing power declines. Yet this year’s survey offers clear signs that, however the slowdown plays out, for most companies the system will reset and the next phase will lift them up rather than cast them down.