Japan is set to become the world’s economic bright spot in 2024, according to Fidelity International analysts covering the country, who see much to be confident about across their sectors in the year ahead.

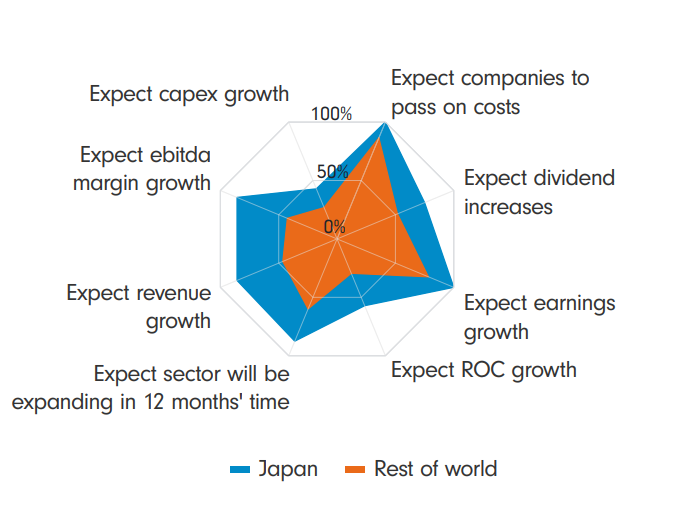

Expectations for revenue and earnings growth in 2024 are higher for Japan than for any other region. Analysts covering Japan are also the most optimistic about widening earnings margins.

Storming ahead

Japan leads the pack when it comes to expectations for capital expenditure, returns on capital, dividend increases, ability to pass on costs to consumers, and whether or not its companies will be in an expansionary phase of the business cycle by this time next year.

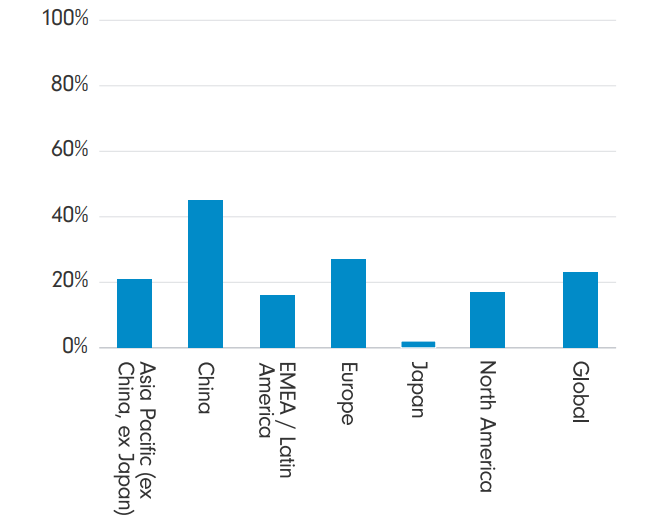

Fidelity’s Japan-focused analysts see plenty of reasons for optimism

Chart shows percentage of analysts expecting a certain trend. Source: Fidelity International, January 2024. The survey was conducted in December 2023.

There is a straightforward reason for much of this optimism. The Japanese economy has finally emerged from more than two decades of recessions and stagnation, with encouraging signs of broad-based price increases. While inflation has been a big headache for much of the world over the last few years, it’s a good problem to have in Japan right now.

“Cost inflation weakened the earnings of medical-device makers last year, but now the companies are able to pass higher costs to their customers,” says healthcare analyst Aki Takaesu. She adds that a shortage of vital components has also eased, further boosting their earnings outlook.

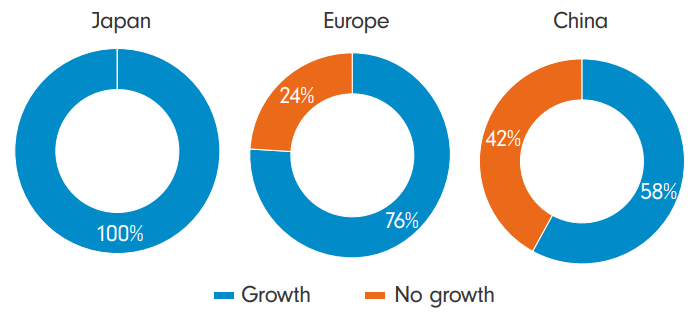

The optimism contrasts with a higher level of caution in our previous annual survey conducted towards the end of 2022. For example, nearly a third of Japan analysts then said that the company CEOs they covered were expecting no earnings growth in 2023, the most pessimistic among all regions except EMEA/Latin America. The current survey has found all Japan analysts saying that CEOs expect earnings to grow.

Similarly, expectations were significantly lower in the previous survey for revenue, earnings margins, and capital expenditure in Japan.

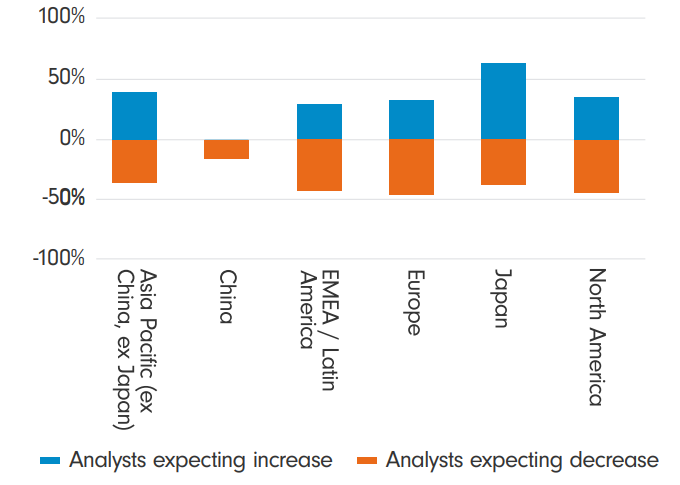

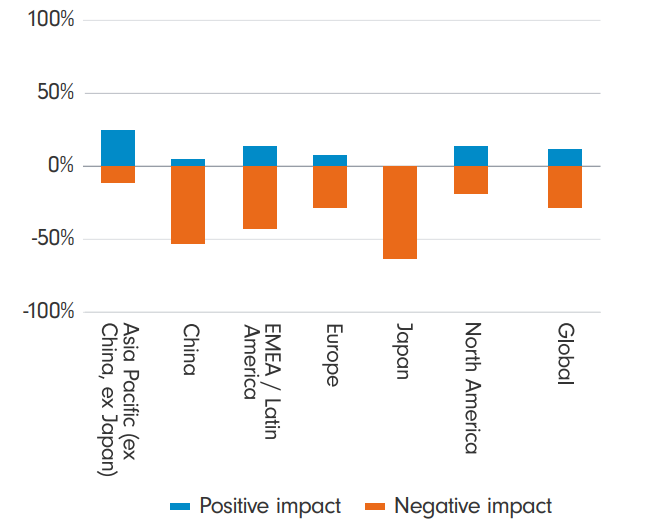

Japan will have more cost inflation than any other region (and that’s a good thing)

Chart shows percentage of analyst responses to the question: ‘How, if at all, do you expect inflationary pressures within your companies’ cost bases to change over the next 12 months?’ Analysts who responded ‘No change’ are not shown on the chart. Source: Fidelity International, January 2024.

Our analysts expect higher cost inflation in Japan than analysts in any other region over the next 12 months. But they also think Japanese companies are the most able to pass on cost increases to customers. In fact, Japan is the only region where all of our on-the-ground analysts believe there can be at least some degree of cost transfer. By contrast, in both China and North America, 16 per cent of analysts think the companies they cover will not be able to pass on any higher costs.

Japanese companies largely avoided customer backlash when they raised prices in 2023, with many of them doing so for the first time in many years. So far, the country’s consumers have shown tolerance for mild price hikes, making it easier for Japanese firms to handle cost inflation.

Business bump

When it comes to earnings, all of the Japan analysts report that their company CEOs are expecting them to grow over the next 12 months. This is a far rosier situation than other regions: 42 per cent of our China analysts and 24 per cent of our Europe analysts say their management teams are not expecting earnings growth at all.

All Japan analysts say CEOs expect earnings growth this year

Chart shows responses to the question: ‘Do the CEOs in your industry sector expect earnings to grow over the next 12 months’ Source: Fidelity International, January 2024

“Strong revenue growth in my sector will be driven by companies accelerating the IT system modernisation in response to an ongoing labour shortage and low cloud penetration in Japan,” says Noriyuki Takizawa, an analyst covering software and IT services. Takizawa adds that CEO confidence in his sector is underpinned by strong order books which has led to backlogs - a clear expansionary signal.

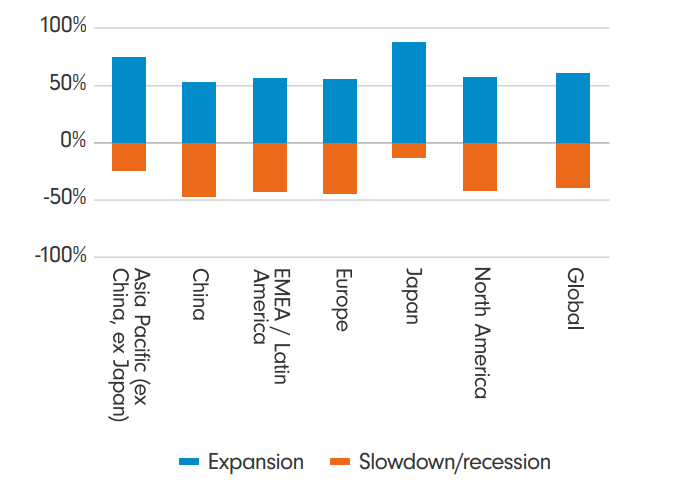

That signal for expansion is broad in Japan: 88 per cent of analysts are projecting an expansionary stage for their sectors in 12 months’ time - the highest across all regions. At a global level, only 61 per cent of analysts envision an expansionary phase at the end of 2024.

Stage of the cycle in 12 months

Chart shows responses to the question: ‘What stage of the cycle will your sector be in in 12 months’ time?’ Source: Fidelity International, January 2024

“For commodity chemicals, the utilisation rate at ethylene plants has been improving over the last few months after hitting its lowest level since the Global Financial Crisis, suggesting that a bottom has been reached,” says materials analyst Karens Muljadi.

In addition, Japanese companies appear to have the lowest need for capital, due partly to adequate cash positions. On average, our analysts in Japan think that only 2 per cent of the companies they cover will need to raise funds in the next 12 months, versus 45 per cent in China and 27 per cent in Europe.

Japanese companies are cash rich and have least need to raise new capital

Chart shows responses to the question: ‘What percentage of your companies do you expect will need to raise capital in the next 12 months, via the equity or bond markets?’ Chart shows average of responses. Source: Fidelity International, January 2024

“Most of the companies I cover are net-cash and generate good cashflows,” says Takaesu. “They are not planning a lot of large investments relative to their recent capex trends.”

Mindful of the politics

Despite the abundant optimism, one distinct risk for corporate Japan that emerges from the survey results is geopolitics. Analysts covering Japan are more pessimistic than any other region about the impact of international tensions.

Geopolitics casts a shadow

Chart shows responses to the question: ‘To what extent is the geopolitical backdrop having an impact on the strategic investment plans (capex and M&A) of the companies that you cover?’ Chart shows weighted average of responses. Source: Fidelity International, January 2024

“Chip-related strife between China and the US may result in my companies, many of which produce semiconductor materials, having to diversify their production bases with excess capex,” says Muljadi. “In a worst-case scenario, they’ll have to take sides and risk losing the revenue stream from one side.”

Japanese automakers could face higher costs too if the US pushes for greater localisation of car production, or if China curbs the export of some essential materials for making electric vehicles amid trade conflicts, according to auto analyst Daichi Ban.

All told, though, Japan still stands out as an economy being lifted by inflation rather than weighed down by it. Our survey’s findings say that will continue in 2024.