Social media and investment apps key information sources

Financial news or publications and investment apps are the two most common method of staying up to date on investment opportunities, closely followed by friends or family, a financial adviser or planner and social media.

Close to 7 in 10 are significantly influenced by their family when making financial decisions. Moreover, 2 in 3 feel comfortable with discussing financial matters with other generations of their family.

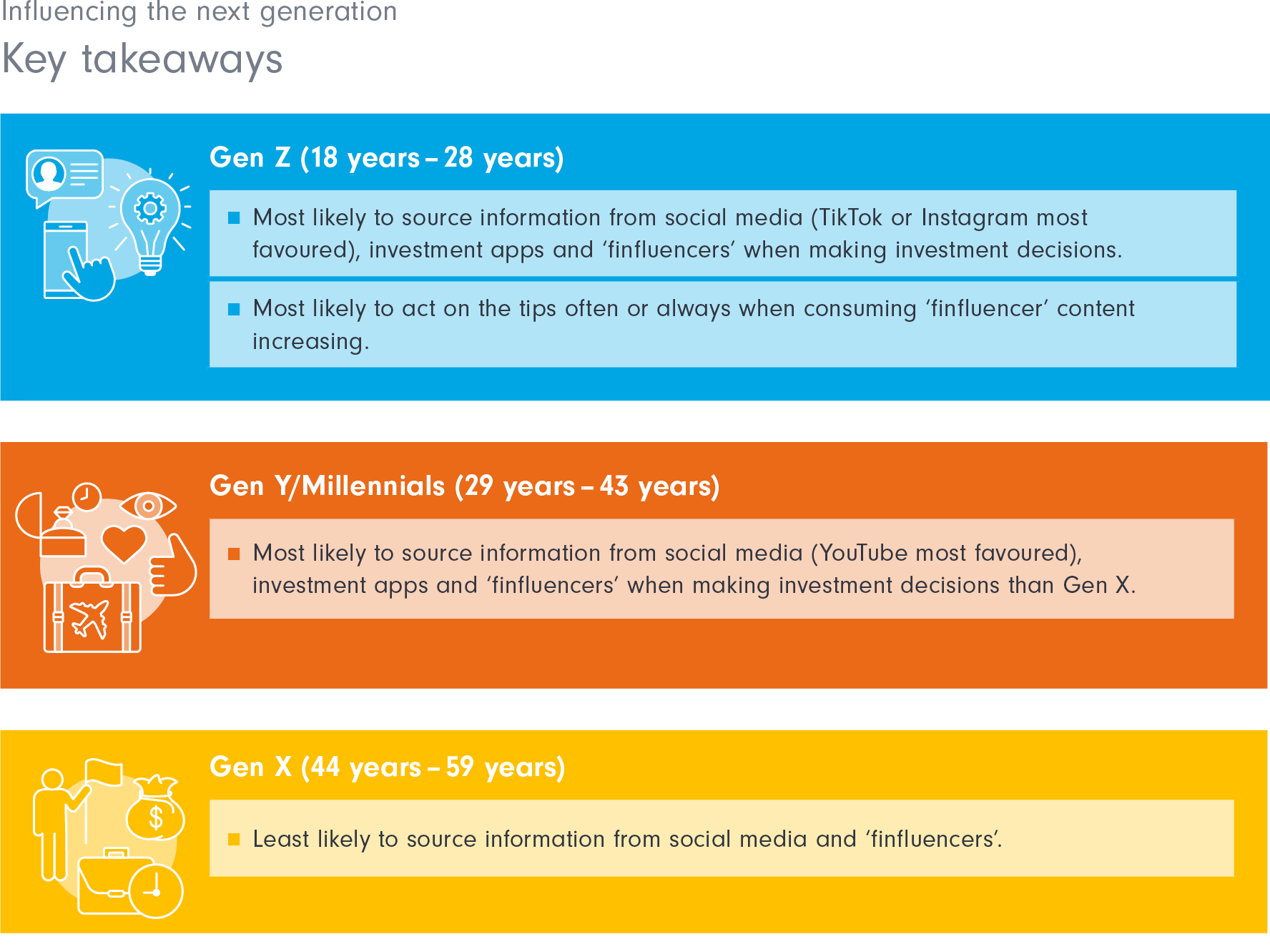

Gen Z are more likely to source information from social media compared with Gen X. Gen Y are more likely to source from investment apps compared with Gen X. The quality of information and independence of recommendations from these sources may vary greatly which can potentially lead to poor financial decisions and outcomes.

The rise of the ‘finfluencers’

One in 5 Gen Z are likely to consider information from ‘finfluencers’ or social media when making investment decisions compared to just over 1 in 10 Gen Y and only 3% of Gen X.

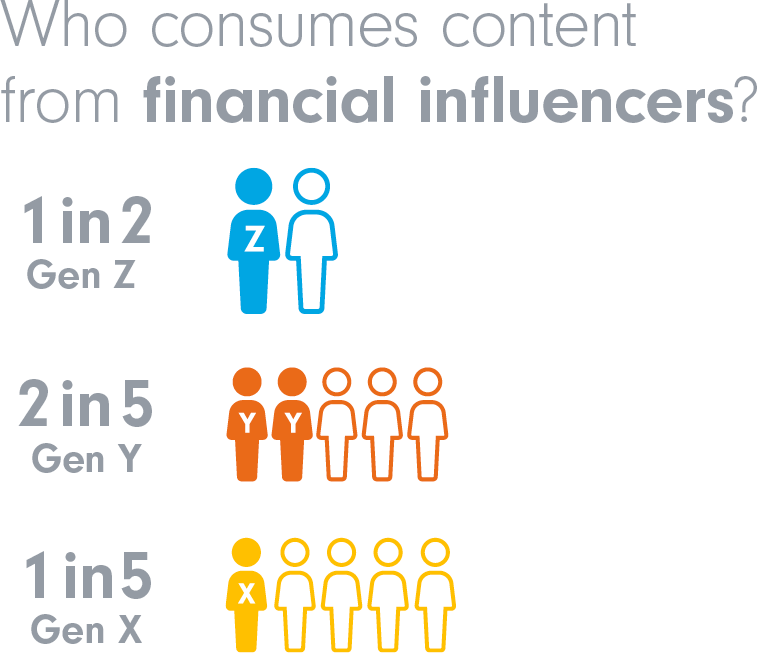

Content consumption from financial influencers varies greatly according to age. When broken down by generation, this includes close to 1 in 2 Gen Z, close to 2 in 5 Gen Y and fewer than 1 in 5 Gen X.

The most popular types of content include saving strategies, wealth building strategies and investment tips.

The most common platforms overall to access them are YouTube, Instagram and TikTok. YouTube is more popular among Gen Y and Gen X while Gen Z prefer TikTok or Instagram.

Download the full report now or explore our other articles