For us stock pickers, views on markets are necessarily driven by what we hear from talking to our companies and the ecosystem they operate in. The micro drives the macro, which is what bottom up stock picking is all about. So what can we tease out about the macro from the micro?

First the state of play

Interest rates are low and the cost of money is cheap. In a nutshell, whether is it governments, corporates or consumers, we are all making promises today that we may not be able to keep tomorrow.

Source: Bank of America Merrill Lynch Global Investment Strategy, Bank of England, Global Financial Data, Homer and Sylla “A History of Interest Rates”(2005).

This low rate environment has had three primary consequences:

-

We have had one of the strongest bull markets across asset classes since the 1970s. Unlike the 2000 tech boom, for example, which was localised in the technology sector, all markets & asset classes from bonds to equities to real estate have participated. This has implications for wealth protection - when the inevitable downturn comes it will be difficult to find places to protect capital. In our current analyses, equities still come out (on a relative basis) as the best house in what is a really bad neighbourhood.

-

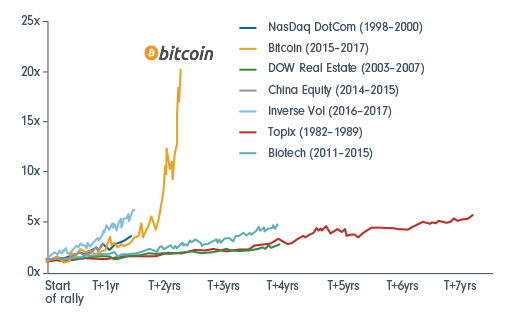

Low rates have also led to some misallocation of capital, and one only has to look towards the price performance of bitcoins to see that indeed there are some bubbles bubbling away - again a symptom of the cheap money.

Source: Fidelity International, Bloomberg

-

Many market participants look at the volatility we see on the social and geopolitical world stage (the real world) and struggle to understand the low levels of volatility in financial markets. In our view this is another function of negative real rates and the low economic growth. It is certainly clear that the current stability is breeding future instability and that we are experiencing the calm before the storm.

How is one to make sense of the way forward? While warning signs flash everywhere, the market continues to rise and the fear of missing out continues to drive investment behaviour. In our view, one needs to continue to engage with markets but without being complacent.

Making sense of the warning lights

To help make sense of these markets, we monitor a simple dashboard of key indicators. The indicators flashing red are all well-known and need less explanation. Those flashing orange need to be monitored closely. But it the indicators currently flashing green that we ought to be most concerned about – a change here will drive the future direction of markets.

Flashing RED

Valuation ratios are near all-time highs, see the Shiller PE in the chart below.

.png)

Source: Fidelity International, Top - S&P & Robert Shiller, Bottom – Bloomberg as at 31 August 2017

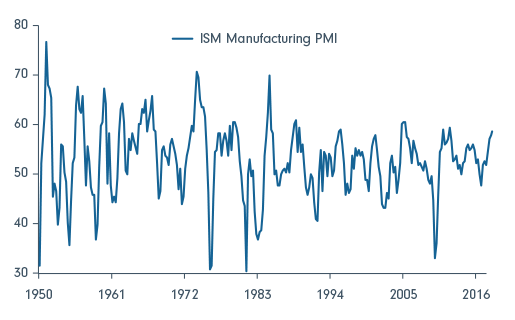

Recently we have seen strong business momentum and for the first time in recent memory companies across the world from Europe to US to Emerging Markets are talking of a recovery in activity. This is well reflected in the ISM Index and unemployment indices, see charts below.

Momentum

Source: Fidelity International, Top - S&P & Robert Shiller, Bottom – Bloomberg as at 31 August 2017

Unemployment

Source: Fidelity International, Top - S&P & Robert Shiller, Bottom – Bloomberg as at 31 August 2017

The main concern here? If things can’t get any better then “buyer beware”; it can probably only get worse.

Flashing AMBER

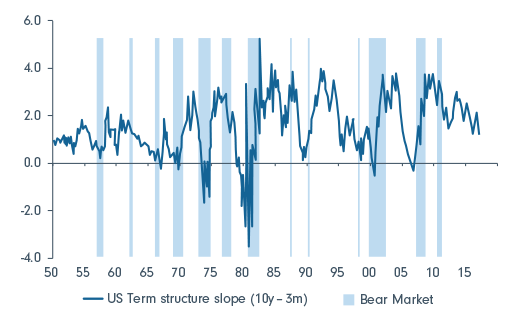

A condition which is normally the precursor to a bear market is the flattening of the yield curve (the difference between the 10yr and 3month rate). This has been happening for a period of time and should make us cautious.

Source: Goldman Sachs Global Investment Research, September 2017

Flashing GREEN

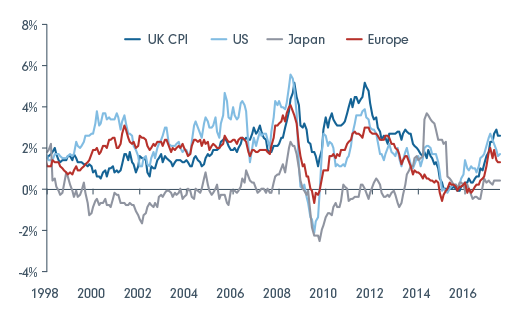

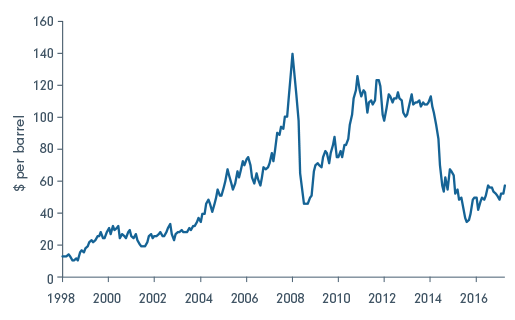

Oil prices, inflation & the labour market: The indicators in green (for now) are those which drive inflation - Inflation is low as oil prices are stable at a low level and there is no hint of wage inflation as markets believe that AI will take the white collar jobs and automation/robotics the blue collar jobs - leaving labour with no pricing power.

Global rates of inflation

Source: Fidelity International, Bloomberg as at 31 August 2017.

Oil price (Brent)

Source: Fidelity International, Bloomberg as at 31 August 2017.

This is where we think things might be changing at the margin. Talking to companies around the World, we get a sense that everyone is finding it difficult to hire: In Japan the cause is demographics and ageing, in the UK Brexit is already creating a shortage of immigrant labour, in Europe construction projects are getting delayed due to short supply of labour and in the US Mexican/Latino labour is in short supply also causing some wage inflation. Furthermore, while overall average wage statistics have not moved, if you peel the onion you can see that millennial wages have been rising smartly - companies have been raising wages to attract labour.

In our view, it is only a matter of time until these trends make it into the headline economic statistics. We consequently believe that interest rates are too low in an environment where economies are moving positively in a synchronized global fashion. After all, central banks can only raise rates (from these unprecedented low levels) in a positive economic environment - no one raises rates in a recession - and it would be nice for policymakers to have some fire power for the next economic downturn.

Acknowledging that falling rates have been a significant factor in taking market levels to where they are, we would expect volatility in equity markets to rise as and when a data dependent Federal Reserve reacts to rising wage pressures pushes policy rates higher.

Investing in this environment

We continue to believe that in an uncertain environment where, to use a cricket analogy everyone is playing for the T-20s, investors are best served to extend their time horizons and play for the Test series. The investor toolkit is simple:

- Understand and analyse the impact of long term trends like demographics and technologies like artificial intelligence on the changing industry structures and profit pools.

- Find and back smart management teams, who can use these trends to their advantage to protect and grow their economic moats - managing disruption smartly is where pricing power will lie.

- Industry analysis needs to be global rather than local. Whether you are analysing Westfield, Coles or Woolworths, the impact of Amazon is important to consider. Having corporate relationships and research on a global basis is no longer a good to have, it is a must have.

- In a market which is absolutely expensive, valuations continue to be our North Star. This is the one area where we believe active management can continue to protect client capital but this will require discipline. As investors searching for value, we must focus on that one variable which is important –cash. Ultimately the value of a stock is the sum of the cash flows that accrue over time to us as shareholders. Cash is generally free from most accounting jugglery. Hence in our analysis, we give a high weight to cash flow metrics, seeking to determine what the free cash flow to shareholders is, how much cash is returned to shareholders as dividends and how much cash is really reinvested back for growth at similar or higher rates of returns.

A final word on disruption

The pace of disruption is increasing. However, we are done with stage one - the disruption itself. The markets have voted who the winners and losers are. As the opportunity set becomes more diverse there are some things the markets are not thinking about; regulation, cyber-security and privacy considerations for the likes of Amazon and Facebook (we will write more to you on this in a future note). There is work to be done to sift through those companies who have been disrupted - some are not giving us any hope to bet on them, whereas others, like JP Morgan & Microsoft, have stood against disruption, spent, partnered and seem to have a strategy to win.

A good diversified equity strategy needs to be considering all these trends and taking advantage of the opportunity that Mr Market offers through identifying strong management teams. Investors need to spend a lot of time analysing industries, with a focus on valuations - in a world of very high valuations you need to avoid the bubbles and the dislocations. To return back to cricket; hit the ones and twos (and the occasional boundary when the opportunity comes) and avoid the value traps – then you have a match winning strategy even if the odds are increasingly stacked against you.