An earnings recovery in focus

The equity market has seemingly embraced the notion that the US Federal Reserve (Fed) will engineer a soft landing and avoid a recession. A recovery in corporate earnings is now needed to drive this narrative forward.

What is the investment outlook for global leaders in 2024, given the prevailing macro environment (slowing global growth, geopolitical, higher rates)?

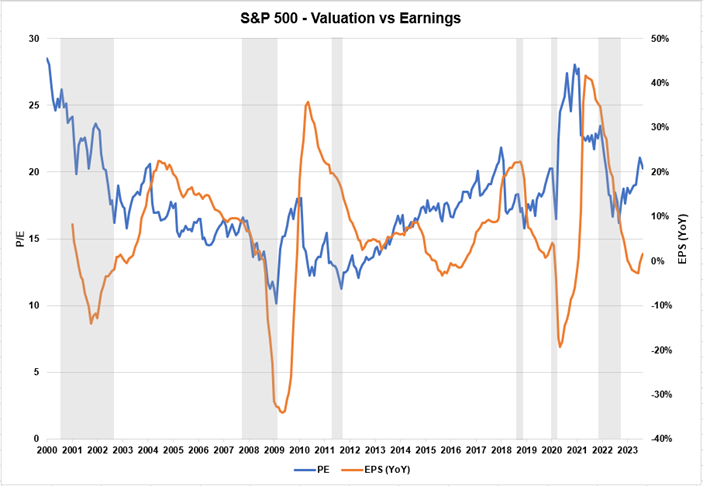

We are at an interesting juncture in global equity markets. Equity markets seemed to have reached a low level in October 2022, during peak fear and pessimism. Since then, investors have increasingly gained comfort in the Fed’s ability to engineer a soft landing, and recession fears have abated. In textbook recovery fashion, valuation multiples troughed first.

The next phase of a typical recovery occurs when earnings rise and valuation multiples pass the baton to fundamentals that become the primary driver of shareholder returns. Given that we have already seen the expansion in valuation multiples, the pressure is now on for an earnings recovery to come through. Otherwise, our gains over the past 12 months might look vulnerable.

Source: Bloomberg, October 2023.

The current macroeconomic backdrop is not the most conducive to earnings recovery, with a stubborn level of inflation driving a higher-for-longer interest-rate narrative. Above-average inflation rates continue to pressure business profit margins, posing a headache for consumers stretching their household budgets.

The excess household savings accumulated throughout the pandemic lockdowns have now largely disappeared. Meanwhile, higher rates pressure the housing sector and corporate cashflows. All of this means that the explosive gains in global markets seen over the last 12 months are unlikely to be repeated next year, and there’s a good chance we’ll also see increased volatility.

What do you think could surprise markets in 2024, either positively or negatively?

With equity markets already pricing in an earnings recovery in 2024, there is a reduced chance of positive surprise. However, we could expect some adverse shocks if the earnings recovery does not materialise. A recession is not off the cards and isn’t reflected in valuations. Thus far, unemployment has remained low, which has been the key to fighting off a recession in 2023, so this remains a critical factor to monitor for any cracks that may emerge. Tensions in the Middle East may continue to put upward pressure on energy prices or drag major global powers into direct conflict.

Within your portfolio, what has worked well in 2023?

Businesses that continued to deliver robust earnings growth were the key drivers of performance in 2023. These companies spanned different sectors and industries, so it was more a case of company-specific characteristics than significant themes that drove returns. Artificial intelligence was a big theme in 2023; however, this largely played out in the large/mega cap segment of the market, given the likes of Nvidia, Microsoft, and Alphabet were among the leading players.

Similarly, the most significant detractors in 2023 were businesses that experienced pressure on their revenues and earnings, and, again, these were industry agnostic. Paying attention to a build-up of headwinds will be important in 2024 to try and minimise any disappointing investments.

What themes, sectors or regions would offer opportunities and potential risks?

Given the cloudy macroeconomic backdrop, cyclically exposed businesses would be potential risks in 2024. Similarly, companies with limited pricing power (who would have to absorb inflation in their margins) or those with leveraged balance sheets (and face increased debt servicing costs) are also key areas of risk to monitor. High-quality, recession-resilient businesses with competitive advantages and pricing power in solid industry structures, managed by talented leaders and bought at reasonable valuations, will continue to offer investors what we believe to be some of the best opportunities going forward.