A focus on stock-specific fundamentals in 2024

The macroeconomic environment in Australia is marked by higher rates, which reduce valuations and increase discount rates, as well as elevated inflation from tight labour markets.

What is the investment outlook for future leaders in 2024, given the prevailing macro environment (slowing global growth, geopolitical, higher rates)?

In 2024, Australian mid-and-small-caps are expected to be modest performers given single-digit earnings-per-share growth forecasts and price-earnings multiples are around long-term averages of 15x. The macroeconomic environment in Australia is marked by higher rates, which reduce valuations and increase discount rates, and elevated inflation.

The latter is driven by tight labour markets and associated wage growth, higher capex and debt servicing costs, volatility from rising bond yields and increasing energy costs from oil prices. At the company level, some sectors, such as insurance, technology, industrials, and utilities, show more positive growth and return trends than average for 2024.

The role of management will be critical in 2024 as they navigate more challenging economic conditions, potential competition and cost pressures in many areas. Companies in market structures that are more niche, critical, and less competitive, with higher pricing power and the ability to recoup cost pressures, will likely fare better.

What do you think could surprise markets in 2024, either positively or negatively?

Markets have moved from a consensus view of a soft landing to more pronounced concerns about slowing growth or recession conditions. Sharp increases in bond yields and higher-for-longer inflation, driven by debt financing, labour, transport, and capex costs, have left the market in a narrow trading range until these factors driving caution change.

Possible positive surprises will be falling interest rates or bond yields in mid-to-late 2024. Negative surprises will be a sharper slowing of earning expectations and higher-for-longer debt financing, labour, transport and capex costs as inflation and bond yields are expected to peak in 2024.

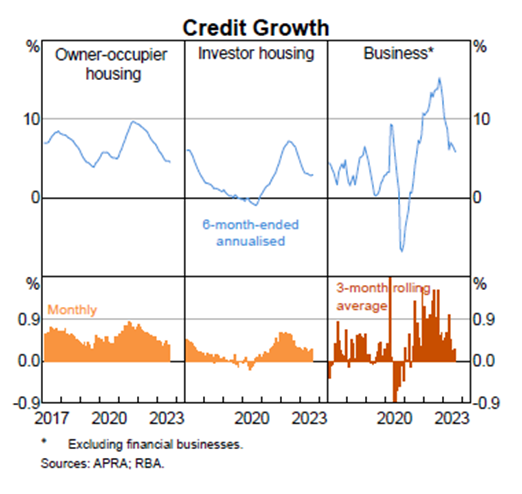

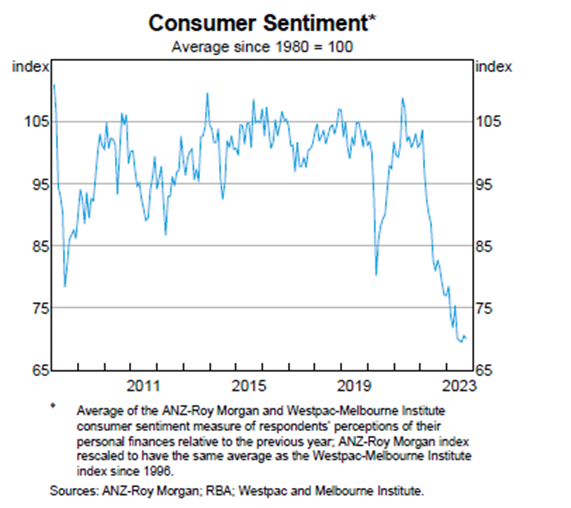

Credit growth for housing and business is slowing, and consumer sentiment index levels remain low (below 2009 levels), as shown below in the Reserve Bank of Australia’s Monthly Chart Pack. Any improvement on these fronts will be a positive surprise.

Within your portfolio, what has worked well in 2023?

Quality growth and momentum earnings trends were the key positive drivers of performance in 2023. The earnings momentum induced by insurance hardening cycle was positive for the distributors in AUB Group and Steadfast. Technology-in-software, fintech and medtech delivered solid earnings and multiples, which benefited the portfolio through holdings in Wisetech, Megaport, Altium, Carsales, Pro Medicus and Hub24.

Industrial service provider Mader was a new entrant to the portfolio that performed well in 2023 due to solid earnings growth and expanding valuations. As the market shifted from recessionary fears at the start of 2023 to a soft-landing consensus halfway through the year, this led to enthusiasm for an economic recovery as the share prices of stocks like Life 360 (marginally profitable and a greater range of valuation) showed strong recovery.

Given residual risks remain as the higher-for-longer climate continues in areas such as inflation, debt costs, wage growth, labour scarcity, rising capex costs and increasing economic uncertainty, our portfolio approach to 2024 should be more cautious. While quality (growth, persistency, higher returns, longer duration, and higher levels of certainty) and momentum may dominate, valuation discipline will be in focus. Earnings risks will be closely monitored, and lower-beta defensives should be considered more seriously. This will balance risks in an investment portfolio should economic deterioration spread across industries.

What themes, sectors or regions would offer opportunities and potential risks?

Insurance, technology and utilities still look attractive, given constructive earnings, persistence, and a positive outlook in an uncertain economic environment. Risk sectors remain consumer and industrial segments due to the economic slowdown. Healthcare is being affected by tighter funding and regulation, as well as the impacts of GLP1, which are having wide-ranging effects on the sector worldwide.

Real estate, utilities and consumer staples are being affected by the bond rates on the debt front. Valuation impacts and higher capex also drive risk for this defensive group. Energy has been buoyed by higher oil prices, but it also faces risk from higher costs, so caution is warranted in the medium term for this universe. Communication services should be a better-than-average proposition, especially the more technology-focused companies across this sector. At the same time, more cyclical names, such as media, are at risk of being exposed to lower advertising revenues.

2024 will be a very stock-specific year where correlations are likely to be low. Navigating the economic environment, innovation and leadership in products and processes, balance-sheet strength and a company’s ability to provide clear, confident guidance on the outlook will become a scarcity for which market investors will likely pay a premium.