The cost of living is hitting hard

The rising cost of living has notably impacted household budgets, with over 1 in 4 feeling extremely impacted and close to 1 in 2 moderately impacted. However, the response to this changes with age.

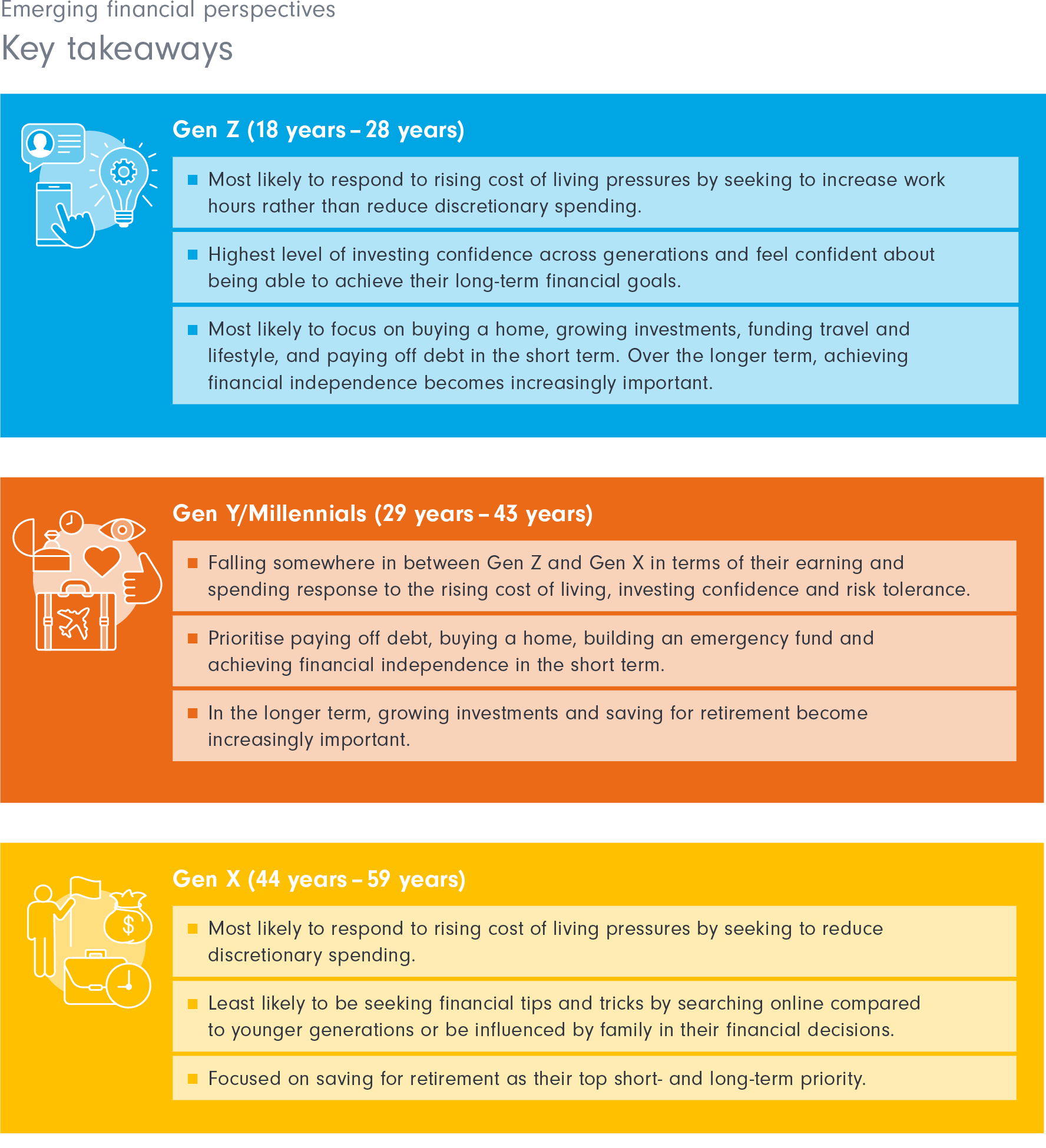

The younger the consumer, the more likely they are to focus on earning more and less likely to cut discretionary spending to adapt.

This may reflect lifestyle priorities and their financial ambitions to get ahead.

In contrast, Generation X is more likely to reduce their spending on non-essential items and significantly less likely to take on additional work or hours.

Financial confidence is high but may be overestimated

Financial confidence among the next generation is generally high, with around 1 in 5 feeling very confident and a further 1 in 2 feeling somewhat confident in managing both day-to-day and broader financial matters. Only a small group, just under 1 in 10, report they lack confidence.

Three in 5 are confident in evaluating investment opportunities, however only 1 in 5 consider diversification of their investment portfolio to a great degree.

Younger investors are more likely to have a higher risk tolerance, commensurate with their longer investment horizon but also possibly reflecting a degree of overconfidence. Around 1 in 3 ‘next gens’ have a high or very high risk tolerance compared to less than 1 in 5 Gen X.

This sense of financial confidence and aspiration to grow wealth, along with higher risk tolerance, will need to be accommodated by financial advisers looking to service emerging next generations. Younger clients may be more inclined to try to ‘get rich quick’ and less disciplined in reining in their spending habits.

Financial goals vary by generation

Paying off debt and buying a home or property are key top-of-mind goals for the next generation, while saving for retirement becomes increasingly more important as a longer term financial goal.

Gen Z are most likely to focus on buying a home or property in the short term along with growing their investments, funding travel and lifestyle, and paying off debt.

Gen Y tend to prioritise paying off debt, buying a home or property, building an emergency fund and achieving financial independence in the short term. In the longer term, paying off debt remains the top priority, but growing investments and saving for retirement become increasingly important.

Gen X are firmly focused on saving for retirement as their top short-term priority, followed by paying off debt and achieving financial independence, which are all sustained as their longer-term goals.

Around 1 in 5 next gens are very confident and 1 in 2 are somewhat confident with achieving their long-term financial goals.

Download the full report now or explore our other articles