With a payments ecosystem that is advanced by global standards and a fast-digitalising economy, Brazil’s fragmented banking industry is undergoing a revolution, creating a constructive backdrop for the market’s nimble digital players.

Brazil’s fast-digitalising banking industry

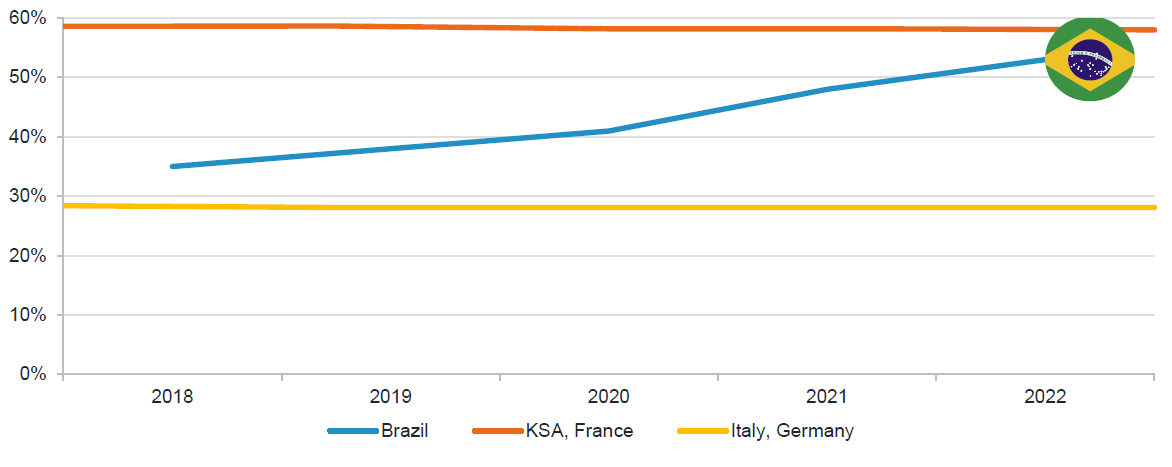

Brazil has a rapidly digitalising economy and digital payments are driving a revolution in its banking industry. The country is leading the shift away from cash with a payments system that is advanced by global standards. According to JP Morgan Research, credit card total payment volumes in Brazil account for over 20% of GDP, relative to regional peers like Peru where the number stands at 6%. When looking at volumes as a proportion of personal consumption expenditures, Brazil also ranks far higher than that of developed economies such as Italy and Germany (see chart 1).

Chart 1. Brazil’s card and digital payments have expanded as a portion of overall spending

System TPV as % of PCE

Source: Fidelity International, Bernstein, Abecs, 31 December 2022.

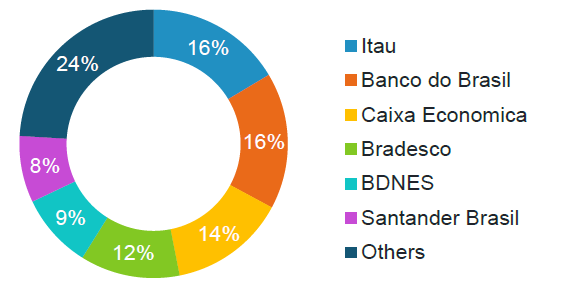

The banking industry in Brazil is large and somewhat fragmented, with no single bank holding more than 16% of the market’s assets (see chart 2). This has created an environment ripe for grabbing market share. The Brazilian banking industry, and particularly that catering to households, is relatively large, with room for leverage to grow.

Chart 2. A fragmented market with scope to grow

Market Share (Total Assets)

Source: Autonomous, 1 August 2023.

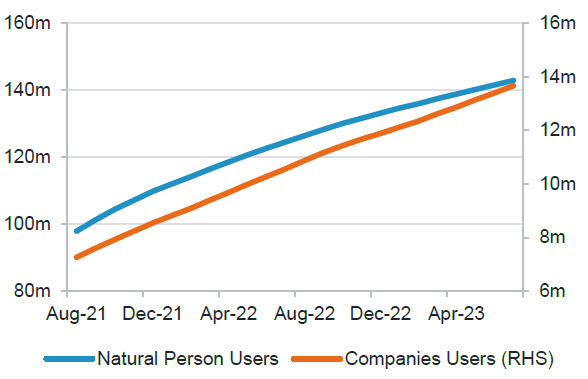

This digital shift has been facilitated by the adoption of solutions like Pix, which is a free money transfer service that launched in November 2020 and is fast replacing cash and wire transfers. The service has expedited the digitisation of the Brazilian economy, encouraging citizens to embrace digital banking. The number of users transacting in Pix has grown rapidly over the past two years, strengthening the incentive for individuals to open bank accounts. The number of Pix transactions doubled from 2020-22 and banks with digital offerings are increasingly looking to monetise this free-to-use solution

Chart 3. A rising number of Pix users

Source BCB, InfoMoney, 31 July 2023.

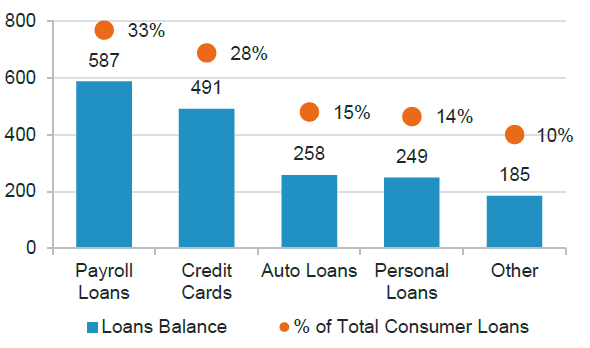

There is also an interesting opportunity in the digital payroll loans market which has grown rapidly and is now of considerable size (see chart 4). Without the same cyclical nature as personal loans, payroll loans are highly coveted product, with strong risk-adjusted economics. Just as digitalisation has disrupted the credit ard and payments market, we now expect payroll loans to also go through a similar revolution.

Chart 4. The Brazilian payroll loans market is already large and a prime target for digital disruption

Payroll Loans Balance and Penetration (R$ billion)

Source: BCB, Morgan Stanley Research, 1 May 2023.

Payroll loans have expanded in Brazil due to relatively low interest rates for borrowers and good unit economics for lenders, with loans making up 33% of total consumer loans in 2022, according to Morgan Stanley. Payroll loans generate excellent returns on capital, which could rise further as interest rates normalise. As fintech companies look beyond credit cards, payments and transaction banking, the focus could shift to payroll loans, which is an area currently dominated by incumbents but is a prime target for disruption.

Case study: Nu Bank

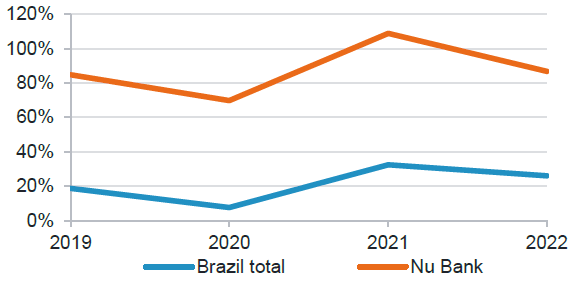

This digitalising backdrop has created a constructive environment for a lead digital player like Nu Bank. The bank is a branchless operator that focuses on digitally fulfilling the basic financing needs of Brazilian consumers. Nu Bank has outpaced the system in TPV growth over the past three years (see chart 5) and has continued to do so into 2023. The strength of its brand is also illustrated by its fast growth relative to incumbents.

Chart 5. Nu’s digital focus has led to rapid TPV growth

YOY TPV growth (%)

Source: Fidelity analyst estimates, company results, 16 August 2023.

While some of the incumbents have 85-100,000 employees and about 3,000 branches, Nu Bank has less than 10,000 employees and zero branches. The newly launched digital platforms of these incumbents had reached only 10 million clients by the time Nu Bank had reached 40 million active customers in 2021. Looking to costs, Nu Bank’s total operating expenditure was almost a tenth of that of some of its peers in 2022. Although other incumbents clearly have a greater reach in relatively complex banking offerings such as investment banking and mortgages, Nu Bank’s reach in digital banking and its cost advantage is stark.

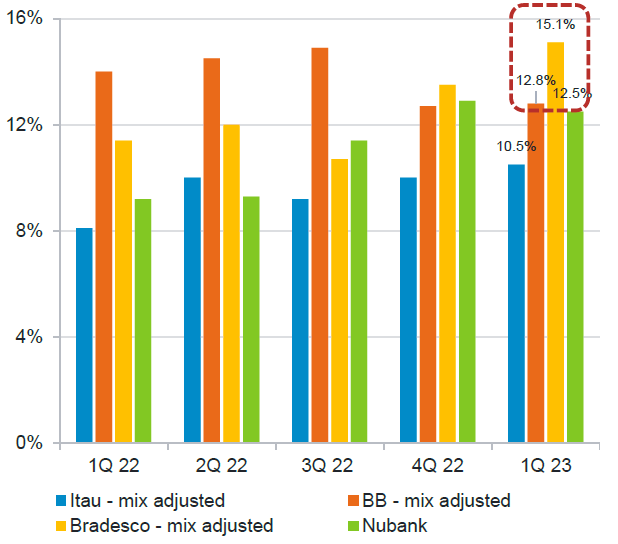

Importantly, Nu Bank’s model has proven resilient in the face of system-wide asset quality deterioration largely due to the success of its business model in catering to a broad variety of segments. While the cost of risk is higher in Nu Bank’s segments, the bank has been able to deliver the same or even better asset quality than its peers (see chart 6). And although Nu Bank slowed personal lending due to concerns about asset quality, we are now seeing it resume growth in this area.

Chart 6. Nu Bank’s asset quality is in line or better than that of peers

Source: JP Morgan, BCB, company data, 14 June 2023.

Nu Bank has been able to expand into fast-growing areas of the market, including Pix and payroll loans. Following Pix’s launch in 2020, Nu Bank has been able to rapidly monetise this free-to-use solution, which represents a cannibalisation risk for fee-collecting card payments. Nu Bank’s financing for Pix has been a key driver for the bank’s growth in interest-earning instalments over the past year.

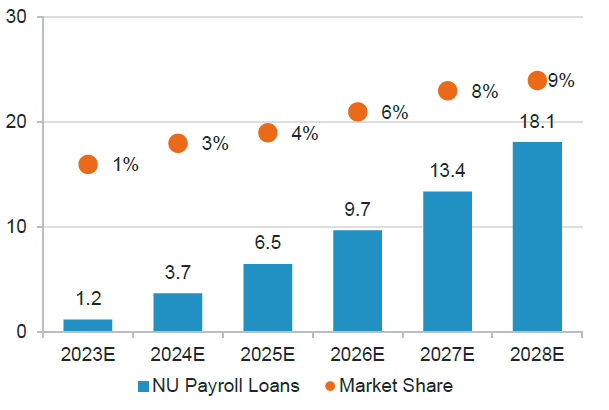

Nu Bank also appears primed to take advantage of the growing payroll loans market. With a large client base and a good cost structure, its client base includes individuals that account for 30% of all outstanding payroll loans in Brazil, according to Morgan Stanley, which offers an excellent cross-selling opportunity

Chart 7. Nu Bank has scope to gain market share in payroll loans

Nubank Payroll Loan Portfolio ($US Billions)

Source: Morgan Stanley Research Estimates, 1 May 2023.

Concluding remarks

Brazil’s digitalising economy and fragmented banking market have created an environment ripe for nimble players such as Nu Bank. We see opportunities across segments, including credit cards, Pix, personal loans, and payroll loans.

The macroeconomic backdrop in Brazil is fast improving, with high real rates, inflation under control and a central bank that has just started cutting rates.

With these tailwinds and a highly fragmented industry that is ripe for companies to take market share, we think there is considerable potential for the digitally savvy operators in Brazil’s banking market.