Attending COP15 (Conference of the Parties) - Using our spheres of influence to effect real-world change

Biodiversity loss is unprecedented and accelerating. Since 1970, there has been around a 68% decline in global wildlife populations, occurring across all geographic regions. Most strikingly in Latin America and the Caribbean where wildlife populations have fallen 94% in the last 50 years. This loss poses material financial risk, with an estimated 50% of global GDP being moderately or highly dependent on nature.

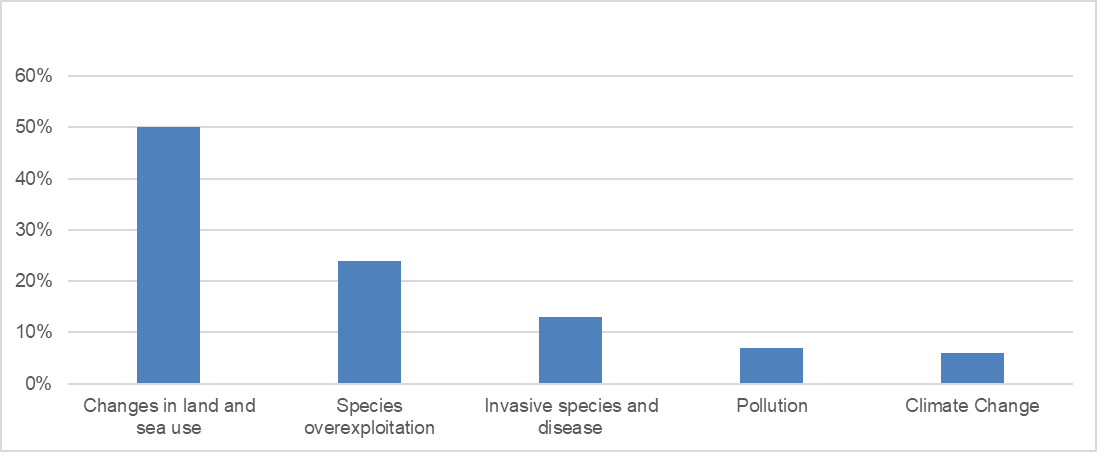

Biodiversity loss is being directly driven by climate change, habitat loss, pollution, overexploitation, and invasive species, largely a result of human activity.

Drivers of global biodiversity loss

Source: World Economic Forum, World Wildlife Fund, Visual Capitalist (November 2020)

Fidelity attended COP15, as part of the Finance for Biodiversity delegation, to engage, learn and come together with representatives from the financial sector and other key stakeholders to help mobilise action on this important issue. Ahead of the conference, we were also one of over 150 financial institutions to sign the Private Financial Sector Statement on Biodiversity, signalling our support for an ambitious Global Diversity Framework. Biodiversity is a growing area of focus for Fidelity, and we have made several key commitments, as a signatory and foundation member of the Finance of Biodiversity pledge and member of the Natural Capital Investment Alliance.

Investment analysts Charlotte Apps and Harriet Wildgoose from the sustainable investing team attended COP15 and discuss their first-hand accounts from the event. They also map out the key takeaways and investment implications.

Inside the COP15 beltway

In December 2022, at COP15, the Kunming-Montreal Global Biodiversity Framework (GBF) was agreed, underpinned by four overarching goals and 23 action orientated targets, with the overarching aim to halt and reverse biodiversity loss by 2030 and achieve full recovery by 2050. The GBF is not legally binding, but it is an important guide on the future direction of policy, at the global and local level. While we believe this probably is not quite a Paris moment, this event will come to be remembered as a step change for biodiversity, or a Montreal moment, if you will.

There was a real sense of momentum at the conference, with companies and financial institutions represented in size for the first time. According to the United Nations (UN), COP15 had over ten thousand delegates, compared to just under four thousand at the biodiversity COP in Sharm El Sheikh, Egypt in 2018. Interestingly, those companies that were present in Montreal were often pushing for more ambitious commitments than those proposed by national governments.

Biodiversity disclosures were also high on the agenda. ‘What gets measured gets managed’ was one of the more popular phrases being employed at the conference. The Taskforce on Nature-related Financial Disclosures (TNFD) was heralded throughout as key to drive this change. Fidelity is a forum member of the TNFD, a risk management and disclosure framework currently in development and due to be finalised in September 2023.

‘Nature positive’ was a key phrase across stakeholder meetings and is fast becoming the “net-zero” equivalent for biodiversity. While the definition of the term “nature positive” is being developed, some companies have already embarked on the creation of their own frameworks and targets to manage their impacts and dependencies, rather than wait for a finalised definition.

There was a great deal of discussion regarding the funding gap for biodiversity. The COP15 agreement seeks to help close the annual US$700 billion funding gap between what we currently spend on the protection of nature and what is required. To bridge this divide, finance will have a crucial role to play. The agreement explicitly covers the emerging market for biodiversity credits, which could play an important role in plugging the gap.

Some of the main targets for COP15 in reducing the threats to biodiversity loss by 2030, along with the investment implications are as follows:

Protection of land/marine areas and restoration of degraded ecosystems

Target 3 aims to ensure that at least 30% globally of the world’s lands, inland waters, coastal areas, and oceans (especially areas of particular importance for biodiversity and its contributions to people), are preserved via conservation. Target 2 aims to ensure that at least 30% of areas of degraded terrestrial, inland water, and coastal and marine ecosystems are under effective restoration. Currently, only approximately 17% of land1 and 8% of our oceans2 are protected and thus increasing the proportion of land and oceans under protection will create challenges and opportunities for certain extractive sectors, like agriculture and food, where a rethink on how we feed, our planet is required to embed more sustainable land use practices and ensure global food security.

Regenerative agriculture can play its part with a conservation and rehabilitation approach to farming systems. It includes changing farming methods to terrace and contour farming, practising rainwater harvesting and storage or regrowing trees to prevent soil erosion. Vertical farming can save a significant amount of land. By stacking plants vertically on shelves or tall pillars, vertical farming allows ten times the yield for a given land area. There are other savings in the offering - aeroponic systems use significantly less water than traditional methods and the need for intensive farming practices can be reduced with topsoil being conserved. A commonly cited barrier for not being able to scale up these practices is the high upfront cost. Further policy support could help overcome these challenges.

Companies like software and technology firm Trimble and agricultural equipment maker John Deere go further with smart agricultural solutions. They include using software and hardware to help farmers plan their crops, execute farm work and track farming operations, whilst maintaining a reliable record of the entire crop year.

Reduction in pesticide usage and plastic waste will improve the health of ecosystems

Target 7 calls for reduced pollution risk from all sources to levels that are not harmful to biodiversity and ecosystem functions and human health. It includes the reduction in nutrients lost to the environment by at least half, reducing the risk of using pesticides and other highly hazardous chemicals by at least half, as well as working towards the elimination of plastic pollution.

Food productivity is directly dependent on essential services provided by nature such as pollination, natural pest control and healthy soils. The application of bio-fertilizers and manures can reduce chemical fertilizer and pesticide use. Biological methods of pest control can also reduce the use of pesticides, thereby minimising soil pollution. The likes of agricultural chemical and seed company Corteva and crop productivity technologies firm Bioceres have both been developing biological insecticide products with the use of biostimulants and biofertilizers to increase nutrient uptake and crop yields, rather than using chemical inputs.

When it comes to reducing plastic waste there is a whole suite of solutions, from reduced packaging and the increasing use of biodegradable materials to the use of alternative materials. Wood fibre is a biodiversity friendly solution compared to plastic. The global paper recycling rate is estimated at 68%3 versus a plastic recycling rate of only 9%4.

Textiles firm Lenzing offers a substitute to synthetic fibres by taking wood from sustainable forestry and uses a highly efficient system of processing all raw materials to produce fibres that can return to the ecosystem at the end of their life cycle. Consumer-oriented packaging business, Graphic Packaging is also employing the use of fibre-based packaging solutions as customers transition to 100% plastic-free alternatives, with products ranging from folding cartons to foodservice and strength packaging.

Meanwhile, some consumer product companies are turning to aluminium as an alternative to plastic, amid a global recycling efficiency rate of 76%5. Aluminium products can be recycled repeatedly, and collection points/processing infrastructure are present almost everywhere that recycling exists. For example, packaging group Ball is a leading provider of aluminium packaging for beverage, personal care, and household products, ideal for a circular economy.

Reduction in food waste significantly curbs waste generation

Under Target 16, the goal is to reduce food waste by at least half. Food waste accounts for 44% of global waste6 and approximately 8-10% of global greenhouse gas emissions7. Approximately 43% of food waste is attributed to homes, 40% consumer facing business and the remaining from farms and manufacturers8. Hence, addressing food waste will require a systematic approach, across the entire supply chain.

Food is often lost or wasted throughout the supply chain. Technology driven solutions are increasingly being pioneered to help track and manage food inventories more efficiently. Labels company Avery Dennison has radio frequency identification (RFID)-based intelligent label solutions designed to provide greater visibility into the food supply chain. The company believes it can help supermarkets reduce food waste by as much as 20% by using RFID-tagged products or pallets to get a more accurate picture of their inventories, monitor food temperatures, and better manage expiry to keep food from spoiling.

Reduction in harmful subsidies goes some way to protect nature

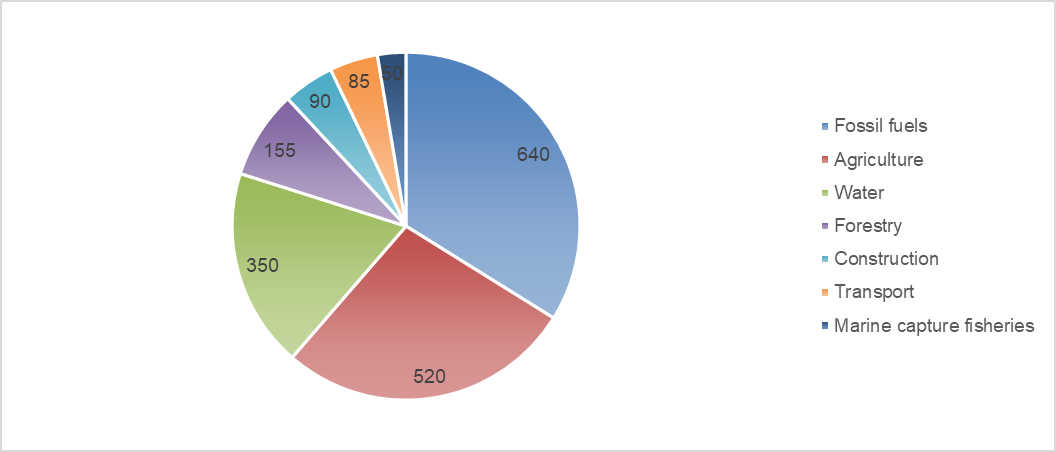

Target 18 calls for a reduction in harmful subsidies by at least US$500bn annually by 2030. However, there is long way to go as governments are estimated to be providing nearly US$2 trillion per year (around 2% of global GDP) on environmentally harmful subsidies.

Estimated global environmentally harmful subsidies (US$bn)

Source: Koplow D. and Steenblik R., Protecting Nature by Reforming Environmentally Harmful Subsidies: The Role of Business, February 2022.

The UN estimates that government spending on subsidies that harm the environment is three to seven times greater than public and private investments in natural solutions. It promotes the extinction of species and the destruction of ecosystems while undermining efforts to implement nature-friendly practises, many of which can be found in alternative agricultural methods.

Disclosure of risks and effects on biodiversity - TNFD development is key

The GBF framework calls for businesses (large and transnational companies and financial institutions) to regularly assess, monitor, and disclose their dependencies, risks, and impacts on biodiversity, as well as to increase beneficial effects, lower risks related to biodiversity and encourage actions to ensure sustainable patterns of production. Even though the framework's final language is softer than the original mandatory nature-related disclosures wording, it clearly outlines expectations for greater transparency, better management, and consistent reporting.

The TNFD is in the vanguard, currently in development and is expected to set the bar for managing and disclosing biodiversity-related impacts, dependencies, risks, and opportunities globally. Strategic implications are emphasised in the design of TNFD, highlighting the importance of location-specific information and improved supply chain traceability, enabling companies to embed nature in their decision-making and risk management. Finally, there must be disclosure. The framework is applicable and consistent worldwide. The goal is to ensure consistency in nature-related assessments and disclosures, which should facilitate financial flows.

Companies that are already playing their part in becoming more transparent

Integrated energy group TotalEnergies and mining firm Anglo American, are both piloting the TNFD framework. Biodiversity assessment is not a new concept to extractive companies, who have been subject to regulations regarding the impacts of biodiversity for a long time. However, the TNFD framework goes a step further in helping these companies integrate this data into their risk management frameworks, better understand their dependencies on nature and embed this into their broader strategic objectives. Disclosure enables stakeholders to better understand how they are managing these critical impacts and dependencies.

By 2026, the luxury goods company LVMH hopes to have complete traceability throughout all its supply chains. They too are testing the TNFD framework. Luxury goods firm Kering has gone one step further and has developed their own environmental P&L (EP&L), measuring the company’s environmental footprint within its own operations and supply chain before calculating its monetary value. Kering has set the target of reducing its EP&L footprint by 40% across its supply chain by 2025, relative to growth, using a 2015 baseline. Meanwhile, global building materials group Holcim has defined its biodiversity level baseline by implementing a biodiversity measurement methodology Biodiversity Indicator Reporting System (BIRS), in partnership with the International Union for

Conservation of Nature (IUCN) across all its managed land by 2024. By 2030, the company is committed to a measurable positive impact on biodiversity.

These cases highlight examples of emerging leading practices which should encourage broader action across sectors, while the TNFD can help facilitate greater consistency in management and disclosures.

Conclusion

We envisage material change off the back of COP15, at both the country and corporate level. Corporates increasingly recognise the value and fragility of critical ecosystems and are rethinking their strategies and commodity value chains, as well as innovating to reduce their negative impacts on nature.

Within the agreed framework, there are some tangible and quantifiable targets to mitigate the damage, with significant momentum across governments, business, finance, and non-governmental organisations (NGOs). However, the framework has drawn some criticism, amid watered-down targets and vague language. For example, under Target 15 (requiring businesses to disclose their risks and impacts on biodiversity) “mandatory” disclosures were omitted from the final text. Under Target 7 (reducing pollution risks), the text on both pesticides use reduction and plastic waste was softened.

Biodiversity stakeholders are increasingly making changes independent of multinational initiatives. Some of the solutions that we have highlighted will help to address some of the goals, but it remains unclear whether they can go all the way. Policymakers will need to step in and implement policy to help facilitate the goals of the GBF. Expect more of the same over the coming years as combating biodiversity gains traction.

Sources

- UNEP-WCMC, UNEP, IUCN - Protected Planet Report, 2020

- UNEP-WCMC, UNEP, IUCN - Protected Planet Report, 2020

- WEF - Plastics and the Environment, June 2022

- OECD - Global Plastics Outlook, February 2022

- International Aluminium Institute, October 2020

- World Bank, ReFed, Goldman Sachs Global Investment Research

- UNEP Food Waste Index Report 2021, Mbow et al., 2019, p200

- World Bank, ReFed, Goldman Sachs Global Investment Research