The latest United Nations Conference of the Parties on Climate Change, known as COP 29, is underway in Baku, Azerbaijan. Despite it being somewhat overshadowed by a busy year of elections and unlikely to attract the same attendance as COP 28, there could still be consequential developments for stakeholders and investors. Below we look at the potential outcomes from COP 29 and their implications for investing.

The COP 29 agenda

New Collective Quantified Goal on Climate Finance: COP 29 is seeking agreement on raising climate funding for emerging markets through adopting a New Collective Quantified Goal on Climate Finance. The existing global climate fund has a target of US$100 billion a year, which took longer than expected to raise. Negotiations are underway to boost funding to potentially as high as US$1 trillion over the next five years through mobilising private finance alongside public funding.

Nationally Determined Contributions (NDC): If emerging markets do not receive more funding, they will struggle to improve their NDCs to meet global emissions cuts next year, as required by the Paris Agreement. It is essential that NDC ambition rises after the global stocktake on emissions at COP 28 showed that the world was not on track to reach net zero by 2050. Current NDCs, even if met, only limit global warming to 2.5-2.9 degrees, which would have catastrophic environmental and social consequences.

National transition plans: Developed markets too need to improve their NDCs and showcase their net zero strategies to attract inward investment. Having a national transition plan and sector pathways with relevant policy measures attached will be essential to convincing capital to mobilise to fund the transition.

Priorities of the COP 29 Presidency

If a new climate finance goal is set, this could boost energy transition investment globally with potential development co-benefits for many countries. Azerbaijan is setting up a fund that accepts voluntary donations from state fossil fuel producers to help countries most affected by climate change with their own transition and rebuilding in the wake of climate-related disasters, although it remains to be seen which countries will support it.

COP 29 Presidency action and ambition

Source: HSBC, 2024.

More promising could be the implementation of Article 6 of the Paris Agreement, which governs carbon trading between countries to help them meet their NDCs. Agreement on Article 6 has been held up by political and technical considerations, for example, what constitutes an offset and how it should be used. Despite slow progress, in June, it was agreed that an offset is not carbon avoidance, only reduction and removal. If the final details are resolved in Baku - and this is far from certain - the resulting market could usher in a new era of carbon trading and feed into improved NDCs.

In addition, the Presidency wishes to grow the Loss and Damage fund, which is designed to help countries adapt to extreme weather and repair damages, review initiatives launched at previous COPs to see how effective they have been at meeting their objectives, and it has floated the idea of a global taxonomy. A global taxonomy looks hard to achieve given the different needs of different countries, but it could support efforts to mobilise transition finance beyond renewables.

In this article:

- Sophie Brodie, Sustainable investing analyst, discusses the potential of COP 29 to unlock investment opportunities in a number of industries. Many renewable technologies are predicted to continue growing, and better climate risk disclosures will add impetus to operational decarbonisation in industries including industrials, chemicals, critical minerals and metals, infrastructure, forestry, water solutions and agriculture. However, investors will need to understand how these trends translate into lasting competitive edges.

- Shamil Gohil, Climate and Social Bond portfolio manager, believes the scale of the financing challenge for addressing climate change is so big that it needs to have a range of stakeholders involved. Public funding is essential, but private finance is equally important to plug the gaps and channel money in an efficient and innovative way. One important area of investment is adaptation strategies. Given only 5% of climate financing is spent on this area, the private sector could play a role in boosting this allocation.

- Julie-Ann Ashcroft and Caroline Shaw, Sustainable Multi-Asset portfolio managers, explain that finding the right balance between energy consumption and the need to reduce harmful emissions is difficult but essential. They believe that nuclear power is a promising but often an overlooked option that could make a significant contribution to meeting the energy demands of the 21st century and lowering carbon emissions.

COP 29 could offer a range of opportunities across sectors

Sophie Brodie, Sustainable investing analyst

Despite low expectations for COP 29, it has the potential to unlock investment opportunities in several industries. Many renewable technologies are predicted to continue growing, and better climate risk disclosures will add impetus to operational decarbonisation in industries including grid connections, industrials, chemicals, critical minerals and metals, infrastructure, forestry, water solutions and agriculture. However, investors will need to understand how these trends translate into lasting competitive edges.

Expectations for COP 29 remain modest given the tough geopolitical backdrop and preparations are already underway for COP 30 in Brazil. As a result, there is potential upside for global equities impacted by long-term transition trends across a range of sectors if these expectations are exceeded.

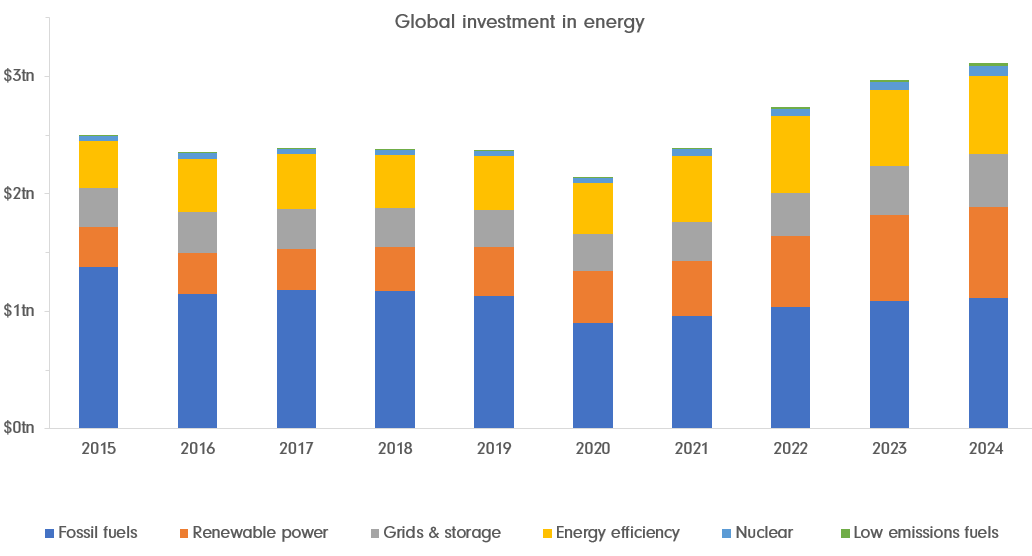

Since COP 28, when many countries pledged to triple their renewables investment and double energy efficiency by 2030, overall investment in renewables has continued to grow, despite higher interest rates and increasingly protectionist measures. The COP 29 Presidency is promoting new targets for energy grid expansion and storage capacity to support the renewables rollout, which could prompt greater investment in these areas. The energy storage target would see countries install 1,500GW of storage capacity by 2030, six times 2023 levels of c.270GW (65% of which was pumped hydro according to the IEA). While pumped hydro can increase further, the lion share of growth in storage is expected to come from batteries. The grid target would add or refurbish 25m km of grids by 2030, which translates to an 8-12% CAGR in global grid investments to the end of the decade, according to analysts at UBS.

Clean energy investment predicted to be twice that of fossil fuels in 2024

Source: IEA, May 2024.

Even if the US withdraws from the Paris Agreement again, many transition trends driven by economics such as solar adoption are likely to remain in place, particularly in countries like China where it is integrated into industrial policy. However, the pace at which technologies need to be adopted globally may slow if a lack of leadership weighs on Nationally Determined Contributions (NDC) ambition in the next 12 months.

At the same time, if Article 6 of the Paris Agreement is agreed we should start to see better pricing in the voluntary carbon markets, giving companies greater confidence in paying to mitigate others’ emissions if they have done all they can to mitigate theirs.

Carbon pricing remains fragmented. But more established trading at country level plus the Carbon Border Adjustment mechanism (adopted by the EU and under consideration by regions as a protectionist measure) is likely to make the cost of carbon more meaningful globally as both a liability and a potential hedging opportunity for most large corporates. This and other risks, including physical climate risks to supply chains from existing temperature changes, will need to be factored into corporate strategies.

Climate risks are increasingly being disclosed under sustainability reporting measures like CSRD in the EU and ISSB in other jurisdictions. As a result, investment trends are moving beyond climate solutions into a broader set of measures undertaken by companies to decarbonise their operations and protect their assets. This is creating opportunities in areas including industrials, chemicals, critical minerals and metals, resilient infrastructure, forestry, water solutions and regenerative agriculture. However, exposure to these sectors will not guarantee outsized earnings trends; investors need to remain focused on which companies are taking market share, whether this is due to innovation or scale, and how they are translating this competitive edge into improved returns in different types of inflationary environment.

Private sector finance can boost funding for adaptation strategies

Shamil Gohil, Climate and Social Bond portfolio manager

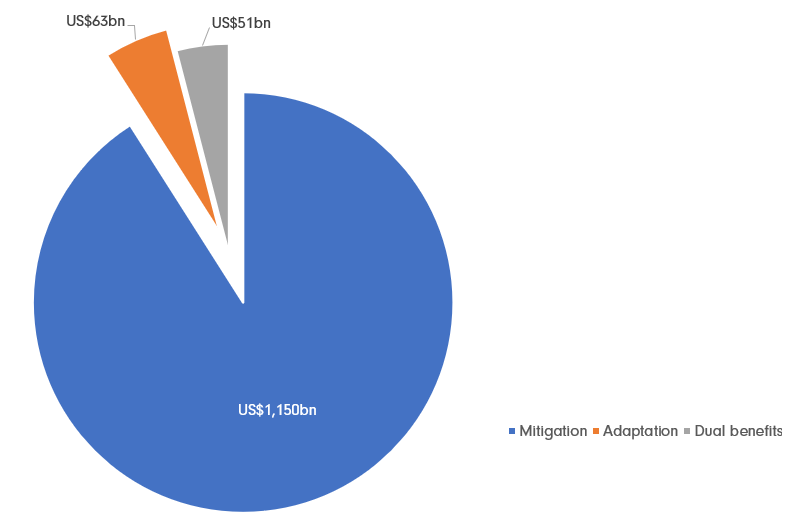

The scale of the financing challenge for addressing climate change is so big that it needs to have a range of stakeholders involved. Public funding is of course essential, but private finance is equally important to plug the gaps and channel money in an efficient and innovative way. One important area of investment is adaptation strategies. Given only 5% of climate financing is spent on this area, the private sector could play a role in boosting this allocation.

COP 29 has been informally dubbed as the “Finance COP”. Climate finance is a crucial enabler of the climate transition, and we expect COP 29 to be a good opportunity to address climate funding by materially involving the private sector. It is therefore important to note that this is the first time (in 15 years) that the collective quantified climate finance goal (or Net Collective Quantified Goal, NCQG) is expected to be agreed. With 2024 on track to be the hottest year on record, it is imperative that climate pledges made by countries at COP 28 last year are translated into real economy outcomes.

It remains to be seen whether the NCGQ will address mitigation only, or also much-needed adaptation and resilience funding. Mitigation has taken priority over adaptation, but as climate impacts are getting worse (more frequent extreme weather events are a stark reminder) and further climate change effects are inevitable, the focus must also shift to addressing the adaptation finance gap.

Currently, only 5% of climate finance flows are channelled specifically into adaptation alone. The private sector will be crucial to driving investment not only in clean energy and nature-based solutions to cut emissions, but also in adaptation strategies to build resilience. This is particularly important for vulnerable countries that are already feeling the effects of climate change. Food and water security should be addressed given the serious repercussions for society.

Landscape of climate financing in 2021/22

Source: Fidelity International, Climate Policy Initiative, October 2024.

Increasingly, there are opportunities for investors in listed securities to support mitigation and adaptation investments through innovative financial mechanisms such as labelled bonds and debt-for-nature swaps - we are closely monitoring how these structures are evolving. Ensuring these vehicles have the right characteristics for inclusion in the relevant portfolios, including the right risk/return profiles, is crucial for making them scalable and replicable for countries and companies around the world.

Finally, as UK based investors, we look forward to and encourage the new UK government moving back into a climate leadership role. Their new plans and targets will be closely watched by the market given they have been mandated to deliver on greater climate ambitions, possibly via a higher pledge on Nationally Determined Contributions (NDC). Given that the UK government wants to invest more in domestic infrastructure, climate mitigation and adaption should be at the top of their green agenda.

COP 29: Nuclear should have greater role in powering the future

Julie-Ann Ashcroft and Caroline Shaw, Sustainable Multi Asset portfolio managers

As the world converges on COP 29, the urgency of addressing climate change remains a paramount concern. Finding the right balance between energy consumption and the need to reduce harmful emissions is difficult. The burgeoning AI revolution, for example, has significant potential to enhance productivity, but requires a lot of energy. We believe that nuclear power is a promising but often an overlooked option that could make a significant contribution to meeting the energy demands of the 21st century while helping to reduce carbon emissions.

AI has the potential to revolutionize industries, enhance productivity, and solve complex problems. However, this technological leap comes with significant energy demands. Training AI models and operating data centres needs vast amounts of electricity. As AI continues to grow, so will its energy footprint. This raises a critical question: how can we develop and utilise beneficial new technology such as AI without exacerbating the climate crisis?

Choosing how to power the needs of humankind involves a complex set of decisions, balancing the pros and cons of each energy solution. Renewable sources like solar and wind are clean and sustainable but can be intermittent and geographically dependent. Fossil fuels are currently abundant and established but contribute heavily to greenhouse gas emissions and climate change.

Nuclear power offers a potential answer. It produces significantly fewer carbon emissions than fossil fuels. Nuclear power plants operate continuously, providing a consistent and dependable energy supply. This reliability is crucial for data centres that require uninterrupted power to maintain operations, something that is harder to achieve with renewable energy sources such as solar or wind power without significantly upgrading the grid infrastructure. In addition, modern nuclear reactors are designed with enhanced safety features and greater efficiency, addressing many of the concerns associated with earlier models. Finally, new reactors, such as small modular reactors (SMRs) can be installed in a greater variety of locations and are quicker to construct than traditional nuclear power plants.

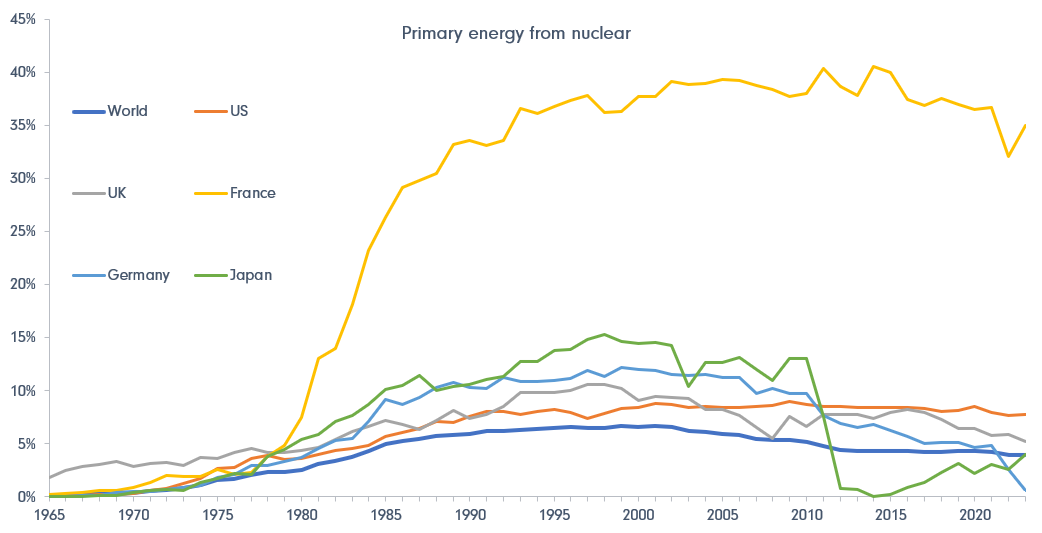

Nuclear energy use has declined in the past 20 years

Source: Our World In Data, Fidelity International, October 2024.

Some of the big players involved in AI are already exploring nuclear power. In October, Google became the first big tech company to commit to nuclear power by ordering six SMRs to power its data centres; Microsoft recently committed to buying 20 years of power from defunct nuclear power plant Three Mile Island when it reopens; and Amazon has partnered with an energy company to explore SMR development alongside its data centre projects in the US. Earlier this year, Amazon agreed a fixed-price nuclear power deal alongside its commitment to build a new data centre adjacent to the existing nuclear power plant.

As delegates gather at COP 29, we hope that policymakers, industry leaders, and environmental advocates recognize that nuclear energy could be part of the solution. We hope to see progress in the following areas:

- Policy support, including funding for research and development, streamlining regulatory processes, and offering incentives for nuclear projects, where appropriate.

- Continued investment in nuclear technology, including exploring next-generation nuclear technologies that may promise greater efficiency and safety, such as SMRs.

- Improving public understanding of nuclear power's benefits and safety.

- International collaboration on nuclear energy development, which could accelerate progress across borders.

We should not pretend that nuclear power is a panacea. It comes with its own set of challenges, such as safety concerns and waste management. However, the path to a sustainable future will be multifaceted, requiring a blend of energy solutions that collectively reduce our carbon footprint while providing space to nurture potentially beneficial technology such as AI. We believe that nuclear power could play a bigger role in helping to balance the global demand for energy with the pressing need to reduce carbon emissions.