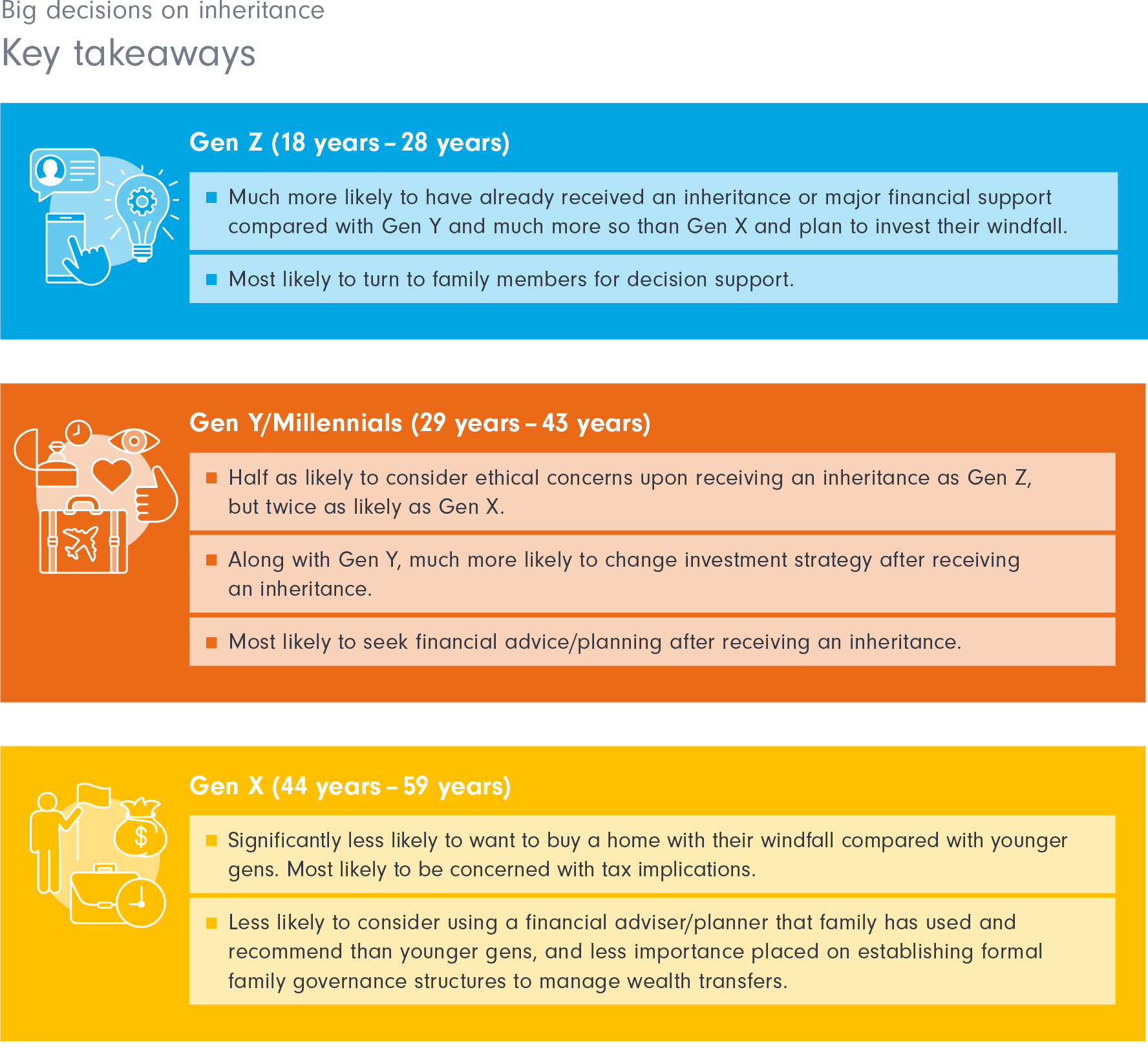

Many next gens have already received some form of financial support or inheritance, and many more expect significant windfalls in coming years. This requires navigating new financial decisions and is a clear opportunity for professional support.

Recipients can find themselves needing support to navigate the legal, financial and investment complexities of inheritance. At this time there is a marked interest in seeking professional financial advice, particularly when recommended by family members.

Great expectations prevail among next gens

Close to 1 in 5 next gens have already received some form of inheritance and 1 in 10 expect to receive even more. A further 2 in 5 believe it is likely that they will receive an inheritance in the future.

For those who have already received an inheritance or are likely to receive one, close to 1 in 2 believe it to be $200,000 or more.

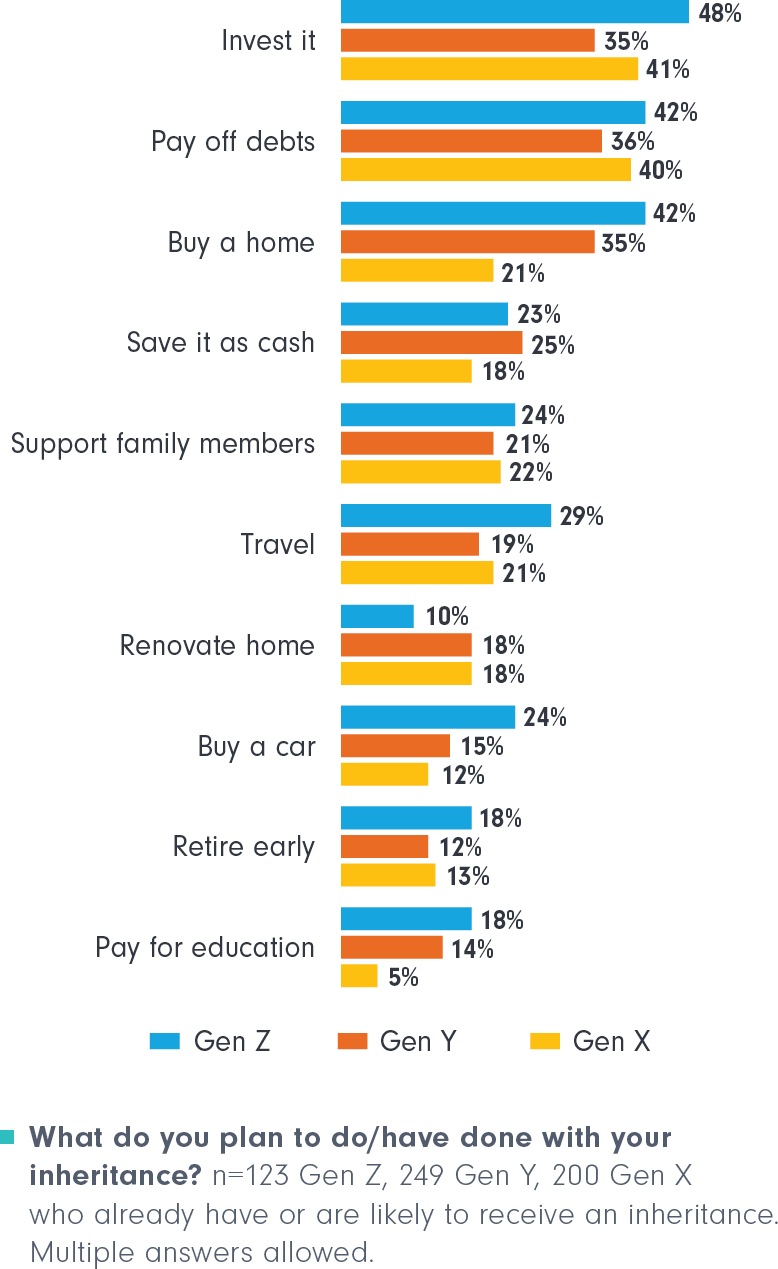

Where will the money go?

The most common uses for an inheritance include investing it, paying off debts, buying a home, saving it as cash, and supporting family members. Gen Z are notably more likely to want to invest their inheritance or windfall than any other generation.

Top 10 plans for inheritance

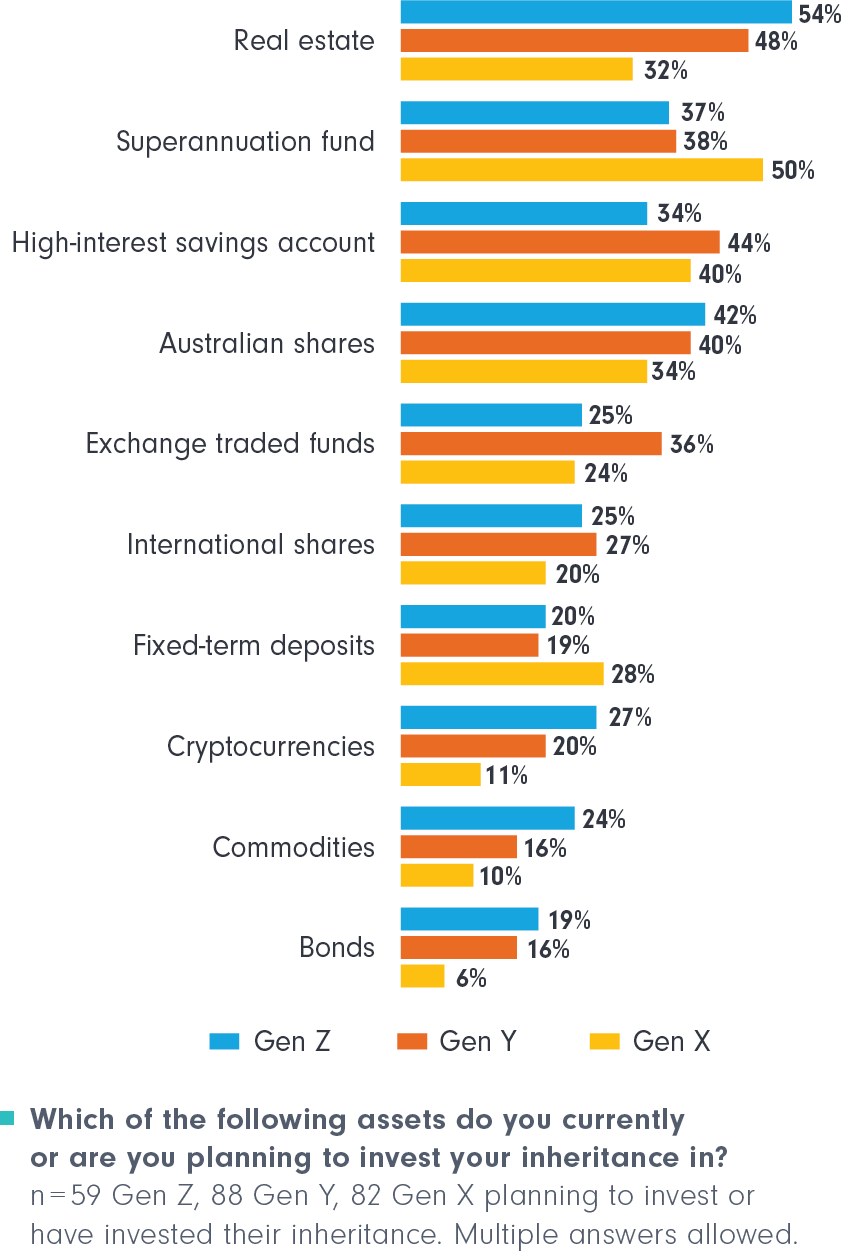

For those investing their inheritance, the most common preferences include real estate, superannuation, high- interest savings accounts, Australian shares and ETFs.

Top 10 investments for inheritance

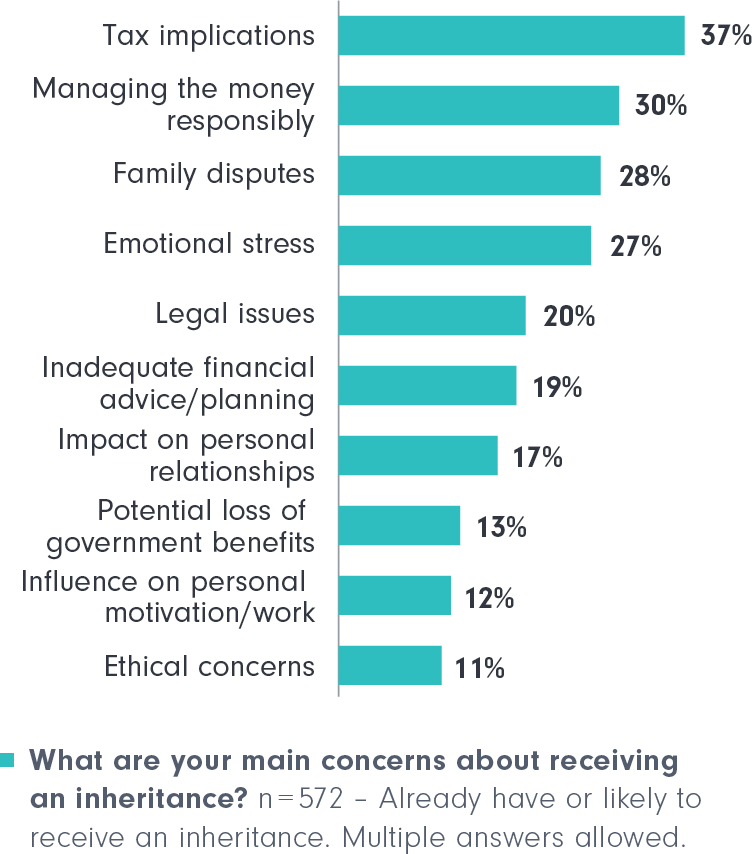

Inheritance concerns and challenges are common. The vast majority of next gens hold at least some concerns about dealing with their inheritance.

The main concerns of receiving an inheritance include tax implications, managing the money responsibly, family disputes and emotional stress.

An emerging theme is ethical concerns, which is a worry for 1 in 5 Gen Z compared to 1 in 10 Gen Y and only 1 in 20 Gen X.

Top 10 concerns surrounding inheritance

Support is required to manage the windfall

More than 3 in 5 next gens say that they are likely to change their investment strategy upon receiving an inheritance, and 2 in 3 would be at least somewhat likely to seek financial advice or planning for this.

Download the full report now or explore our other articles