Global emerging markets are facing multiple challenges. Higher interest rates in the US are making

investors wary of all risk assets, including emerging market equities.

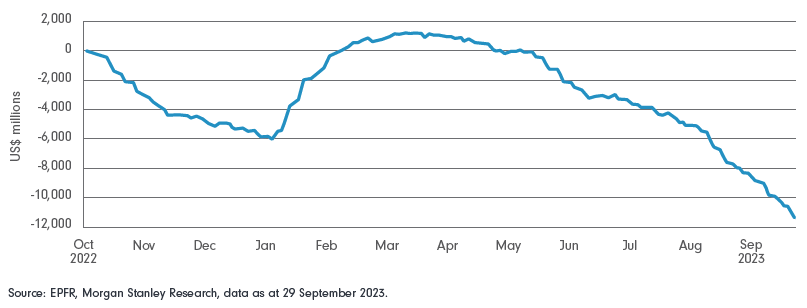

China, the largest component of the asset class, is grappling with reduced growth, increased regulatory scrutiny, and geopolitical tensions. All this is resulting in record outflows as global investment managers reduce active positions, particularly in China/Hong Kong, and leading to a multiple derating that is disproportionately larger than the slowdown in earnings.

We remain conscious of the macro risks and focussed on our investee companies’ quality and risk-adjusted returns potential. The fund has also been adversely impacted but considering structural growth opportunities we consider this to be a favourable time to add to our portfolio of high-quality companies at a very reasonable price.

The Fund has lagged the MSCI Emerging Markets Index so far this year

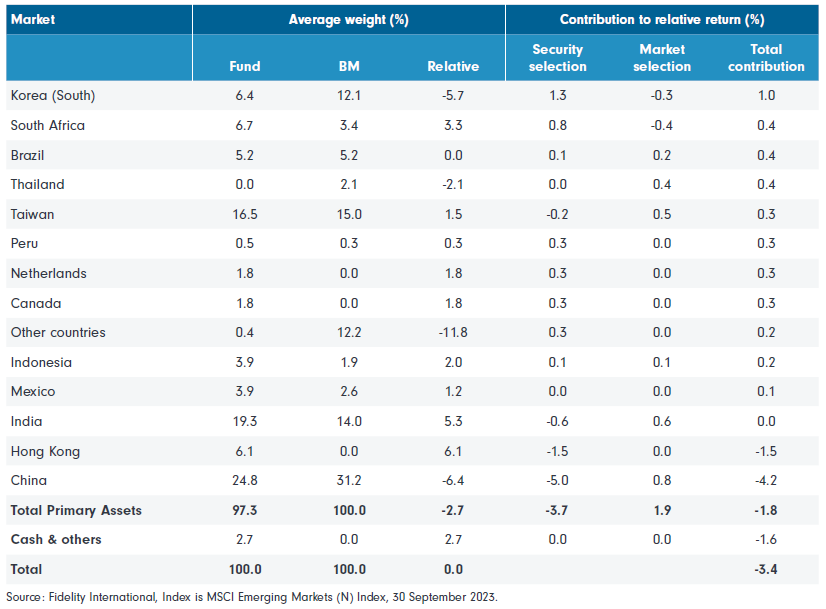

The underperformance so far this year (to end of September) is primarily due to our investments in China and Hong Kong. The table below shows that we had a large negative impact of stock selection from these two markets, while the rest of the positions made positive contributions.

Note that our exposure to China/Hong Kong is quite differentiated versus the index. We do not own exporters or companies that might get caught in geopolitical issues. We are also underexposed to Chinese internet giants where there is a high chance of regulatory scrutiny. Our holdings are concentrated in areas driven by domestic consumption, where we see a long runway of sustainable high growth. This slowdown in consumption has certainly slowed revenue growth, but the adverse impact of weak sentiment and sell-off from global investors looking to reduce their China exposure has been exceptional and disproportionately large on stock prices. Most of our holdings are now trading at historically low valuation multiples, discounting about 15% to 20% long term cost of capital, which makes them very attractively priced.

We toured China in May of this year and concluded consumption is bound to recover from current levels due to pent-up demand and high savings rates. The trip gave us further confidence in our China holdings as winners in their respective categories, and we found that many were strategically adding to their market share in the weaker operating environment.

Daily cumulative net fund flows (US$millions) on China/HK equities from US & EU domiciled funds

Country attribution versus MSCI Emerging Markets (M) Index - 1 Jan 2023 to 30 Sep 2023

Detractors and how we’re viewing them

Looking at the attribution data, seven out of the top ten detractors from performance were companies listed in China/Hong Kong:

Li Ning hurt us the most, largely due to negative consumer sentiment. Our conviction in the domestic sportsware company is driven by their focus on functional products, prudent inventory management and emphasis on creating a long-term sustainable business that can increase market share in a high growth market. It’s also trading at about a 40% discount to its reasonable valuation by our estimates.

Zhengsheng Group reported a fall in profits and new car sales in the first half of this year. However, it remains the biggest car retailer in China with strong luxury brands. The company is increasingly focusing on its more stable operations including used car sales, centralised repair centres, and becoming the best auto services brand for consumers.

China’s second largest dairy company and largest high-end UHT brand, China Mengniu Dairy, has seen 7% to 8% EPS downgrade, but its PE multiple has halved. While milk consumption has a lot of room to grow over the long term, cyclical recovery is happening at a slower speed. The company’s focus is on adult nutrition, which is a higher secular growth area in an ageing population. The management seems more confident on margin expansion this year, partly due to a fall in raw milk cost.

Valuations of our holdings derated disproportionately higher that their earnings slowdown

As consumer confidence returns, and the cyclical slowdown in demand turns, these companies should come out stronger and we’ve added to these positions at an attractive price.

Managing risk when investing in China

China is currently facing several headwinds. Firstly, there is a regulatory risk, especially for businesses with multiple touch points with Chinese consumers. Secondly, weak consumer confidence is resulting in lower-ticket-size purchases, more cautious spending, and increased emphasis on value for money. Consumers are currently opting to pay off mortgages and car loans rather than to borrow and spend. Domestic investors are not ready to look through this cyclical slowdown in consumption, while long-standing foreign institutional investors are indiscriminately selling good quality Chinese businesses since they’re also wary of the other key risk – the growing geopolitical tussle with the US.

In our view, we recognise that the risk in China has gone up and have raised our risk premium on Chinese companies. That said, we strongly believe the country is still very much investible and it’s not the time to sell out.

An overweight to India

We have a positive view on India from a mid- to long-term perspective due to structural growth opportunity in consumption, sustained high economic activity and improved government finances. In addition, higher government revenues and more efficient use of capital is being used to build infrastructure, an area where India has lagged. This infrastructure build-up alongside production-linked incentives for manufacturing is a key positive for the medium- to long-term sustainability of India’s economic growth through higher consumption and employment.

There are some concerns from investors around the relatively high valuations of Indian equities. However, the market’s higher valuation is justified by its consistently higher return on equity. Also, the index valuations hide the wide disparity in valuation at the stock level, leading stock selection opportunities from a bottom-up basis. Our exposure is essentially through a focused set of holdings in private sector banks and non-banking financials, consumer names and globally competitive IT services companies.

We have increased exposure to companies benefiting from supply chains shifts, in the consumer electronics and chemicals spaces. The chemicals company, SRF, manufactures a wide range of products including fluorospecialty chemicals, refrigerant gases, and packaging films. We expect the company to sustainably grow at a double-digit rate over the next decade.

Greater exposure to Latin America through investments in Brazil and Mexico

Brazil has always been a tough market for us because the long-term structural growth is low (at around 1% to 2%) and more volatile (with frequent recessionary periods). Also, the cost of capital in Brazil is very high – interest rates have averaged at around 7% to 8% in the last 10 years. This means cost of capital and risk-free rate or discount rate we use to value Brazilian businesses are higher. We’re therefore always very selective about: (1) what we want to own; and (2) when we invest, to be able to generate alpha in Brazil. We were underweight Brazil last year as interest rates moved up to about 13% from around 3% at the start of 2022.

We started to find interesting investment opportunities early in 2023 when valuations were cheap, interest rates peaked and inflation fell, leading to positive real rates. These positions have contributed to the fund’s performance this year to partially offset the losses from China. For instance, the position exchange operator B3, which was added in early 2023 when equity trading velocity was close to 5–7-year average, due to high interest rates on fixed deposits and valuation was low, did well this year as trading volumes improved on expectations of a 5% to 6% rate cut in Brazil. We also own positions in a car rental company and a bank in Brazil. These positions have also contributed positively to the Fund’s performance this year.

Mexico is slightly different. Its structural growth profile has improved because its proximity to the US is leading to a marked increase in nearshoring of global supply chains. Our channel checks suggest that the number of projects being implemented in Mexico today are the among the highest in the last 10 to15 years as the US is reducing its trade deficit with China. Since this change is more structural, we have a more constructive view on Mexico over the medium to long term.

We have exposure in Mexico’s best quality bank, Grupo Financiero Banorte, which is expected to benefit from the trend towards nearshoring are businesses take credit to expand capacities. The bank has robust asset quality with loan book well-diversified across lower-risk segments and a strong track record in underwriting.

Also, leverage among retail Mexican clients is minimal, leading to structural growth opportunities. We also own Grupo Aeroportuario del Pacifico, which operates 13 airports in Mexico, catering to a combination of leisure and commercial travellers. The stock should see a structural growth in revenues from: (1) passenger volume growth; and (2) higher investments in non-aeronautical parts of the business such as commercial spaces, which should lead to higher medium-term growth.

Overall, global emerging markets are facing multiple challenges, but we have a strong conviction that it’s a good time to invest, as fundamentals remain strong and we are at a better starting point in terms of valuations versus developed markets. That said, there’s still the need to separate the wheat from the chaff… and use active stock selection based on fundamental analysis to construct a portfolio of high-quality companies that can generate sustainable returns over the medium to longer term.